The Future of Banking: Navigating Trends in the Banking Industry 2025

Related Articles: The Future of Banking: Navigating Trends in the Banking Industry 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Future of Banking: Navigating Trends in the Banking Industry 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Future of Banking: Navigating Trends in the Banking Industry 2025

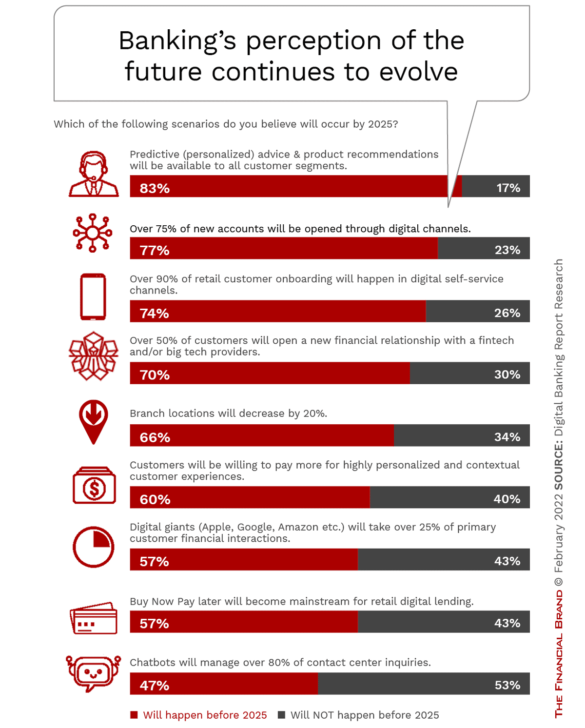

The banking industry is undergoing a rapid transformation, driven by technological advancements, evolving customer expectations, and a dynamic regulatory landscape. As we approach 2025, the industry is poised for significant changes that will reshape the way financial services are delivered and consumed. Understanding these trends in the banking industry 2025 is crucial for banks, financial institutions, and consumers alike, as it enables them to adapt, innovate, and thrive in the evolving financial ecosystem.

1. The Rise of Open Banking and Data Sharing

Open banking, a concept that allows consumers to share their financial data securely with third-party applications, is rapidly gaining traction. This trend is fueled by the increasing demand for personalized financial services and the desire for greater control over personal finances.

-

Impact: Open banking empowers customers to manage their finances more effectively, access innovative financial products and services, and benefit from personalized financial advice. It also opens doors for fintech companies to develop innovative solutions that leverage customer data, leading to increased competition and a more dynamic financial landscape.

-

Benefits:

- Enhanced Customer Experience: Open banking enables customers to access and manage their financial data seamlessly across multiple platforms, enhancing their overall banking experience.

- Personalized Financial Services: By leveraging customer data, financial institutions can offer tailored financial products and services that cater to individual needs and preferences.

- Increased Financial Inclusion: Open banking can facilitate access to financial services for underserved populations by connecting them with innovative fintech solutions.

- Innovation and Competition: Open banking fosters innovation and competition within the financial services industry, leading to the development of new products and services that benefit consumers.

2. The Growing Influence of Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are revolutionizing the banking industry by automating processes, improving risk assessment, and enhancing customer service. These technologies enable banks to analyze vast amounts of data, identify patterns, and make informed decisions.

-

Impact: AI and ML are transforming various aspects of banking, including:

- Fraud Detection: AI-powered algorithms can detect fraudulent transactions in real-time, reducing financial losses and improving security.

- Credit Risk Assessment: ML models can analyze creditworthiness more accurately, enabling banks to make faster and more informed lending decisions.

- Personalized Customer Service: Chatbots and virtual assistants powered by AI can provide personalized customer support 24/7, improving efficiency and customer satisfaction.

- Financial Planning: AI-driven tools can help customers manage their finances, create budgets, and achieve their financial goals.

-

Benefits:

- Increased Efficiency: AI and ML automate repetitive tasks, freeing up employees to focus on more strategic initiatives.

- Enhanced Security: AI-powered fraud detection systems can prevent financial crimes and protect customers from unauthorized access.

- Improved Customer Experience: AI-driven tools provide personalized and efficient customer service, enhancing customer satisfaction.

- Data-Driven Insights: AI and ML enable banks to extract valuable insights from data, improving decision-making and strategic planning.

3. The Rise of Fintech and the Blurring of Lines Between Traditional and Digital Banks

Fintech companies are disrupting the traditional banking industry by offering innovative and customer-centric financial solutions. These companies leverage technology to provide services such as mobile payments, peer-to-peer lending, and investment management, challenging the status quo and forcing traditional banks to adapt.

-

Impact: The rise of fintech is leading to increased competition, innovation, and a shift towards digital banking. Traditional banks are responding by investing in technology, developing digital banking platforms, and partnering with fintech companies to enhance their offerings.

-

Benefits:

- Increased Competition: Fintech companies are introducing new and innovative products and services, forcing traditional banks to improve their offerings and become more customer-centric.

- Financial Inclusion: Fintech companies are providing financial services to underserved populations, expanding access to financial products and services.

- Enhanced Customer Experience: Fintech companies are focusing on providing seamless and intuitive digital banking experiences, meeting the demands of tech-savvy consumers.

4. The Growing Importance of Cybersecurity

As the banking industry becomes increasingly digital, the threat of cyberattacks is growing. Banks are investing heavily in cybersecurity measures to protect customer data and prevent financial losses.

-

Impact: Cybersecurity is becoming a top priority for banks, requiring them to invest in robust security systems, implement strict data protection protocols, and educate employees about cybersecurity best practices.

-

Benefits:

- Data Protection: Strong cybersecurity measures protect customer data from unauthorized access and cyberattacks.

- Financial Security: Cybersecurity helps prevent financial losses resulting from fraud and data breaches.

- Reputation Management: Maintaining strong cybersecurity practices helps protect the reputation of banks and build trust with customers.

5. The Growing Demand for Sustainable Banking

Consumers are increasingly demanding that banks prioritize sustainability and social responsibility. This trend is driving banks to incorporate environmental, social, and governance (ESG) factors into their business practices.

-

Impact: Banks are developing sustainable banking products and services, investing in renewable energy projects, and engaging in responsible lending practices. This trend is leading to a more ethical and sustainable financial industry.

-

Benefits:

- Environmental Sustainability: Sustainable banking practices help mitigate climate change and promote environmental responsibility.

- Social Impact: Banks are supporting social causes and promoting financial inclusion through their products and services.

- Enhanced Reputation: Banks that prioritize sustainability are seen as more trustworthy and ethical, attracting customers and investors.

6. The Shift Towards Digital-First Banking

The increasing adoption of mobile devices and the growing preference for digital banking experiences are driving a shift towards digital-first banking. Banks are investing in user-friendly mobile apps, online banking platforms, and digital onboarding processes to meet the demands of digitally savvy customers.

-

Impact: Traditional branch networks are shrinking as customers increasingly rely on digital banking channels. Banks are adapting by optimizing their digital platforms, providing 24/7 customer support, and offering personalized digital banking experiences.

-

Benefits:

- Convenience and Accessibility: Digital banking allows customers to access their accounts and perform transactions anytime, anywhere.

- Improved Customer Experience: Digital platforms offer a seamless and intuitive banking experience, enhancing customer satisfaction.

- Cost Efficiency: Digital banking reduces operating costs for banks, allowing them to offer competitive products and services.

7. The Growing Importance of Data Analytics

Data analytics is becoming increasingly crucial for banks to understand customer behavior, identify market trends, and optimize their operations. Banks are leveraging data analytics to personalize customer experiences, improve risk management, and make informed business decisions.

-

Impact: Banks are investing in data analytics platforms, hiring data scientists, and developing data-driven strategies to gain a competitive advantage.

-

Benefits:

- Customer Insights: Data analytics provides valuable insights into customer behavior, enabling banks to personalize products and services.

- Risk Management: Data analytics helps banks identify and mitigate risks, improving financial stability and security.

- Operational Efficiency: Data analytics optimizes banking operations, reducing costs and improving efficiency.

8. The Emergence of Blockchain Technology

Blockchain technology is revolutionizing the financial industry by providing a secure and transparent platform for transactions. Banks are exploring the potential of blockchain for various applications, including cross-border payments, trade finance, and asset management.

-

Impact: Blockchain technology is transforming the way banks conduct transactions, reducing costs, improving efficiency, and enhancing security.

-

Benefits:

- Enhanced Security: Blockchain technology offers a secure and tamper-proof platform for transactions, reducing the risk of fraud.

- Increased Efficiency: Blockchain streamlines transactions, reducing processing times and costs.

- Transparency and Traceability: Blockchain provides a transparent and auditable record of transactions, enhancing trust and accountability.

Related Searches

- Banking Technology Trends 2025: This search explores the specific technologies shaping the banking industry in 2025, such as AI, ML, blockchain, and cloud computing.

- Future of Banking Industry: This search delves into the broader future of the banking industry, including predictions about the impact of technology, regulatory changes, and evolving customer expectations.

- Banking Industry Trends 2025: This search provides a comprehensive overview of the key trends impacting the banking industry in 2025.

- Digital Banking Trends 2025: This search focuses on the specific trends shaping the digital banking landscape, such as mobile banking, online banking, and digital onboarding.

- Fintech Trends 2025: This search explores the emerging trends in the fintech industry, including the development of new financial products and services, the impact of regulatory changes, and the increasing competition from fintech companies.

- Banking Industry Outlook 2025: This search provides a detailed analysis of the current state of the banking industry and forecasts for the future.

- Impact of Technology on Banking: This search examines the transformative impact of technology on the banking industry, highlighting the benefits and challenges of technological advancements.

- Customer Expectations in Banking: This search explores the evolving expectations of customers in the banking industry, emphasizing the need for personalized experiences, digital convenience, and innovative financial products.

FAQs

Q: What are the biggest challenges facing the banking industry in 2025?

A: The banking industry faces several challenges in 2025, including:

- Maintaining profitability in a competitive landscape: The rise of fintech companies and the increasing demand for digital banking services are putting pressure on traditional banks to maintain profitability.

- Adapting to evolving customer expectations: Customers are demanding personalized experiences, digital convenience, and innovative financial products, requiring banks to adapt their offerings and service models.

- Managing cybersecurity risks: The increasing reliance on digital technologies exposes banks to growing cybersecurity threats, requiring robust security measures and continuous vigilance.

- Meeting regulatory requirements: The regulatory landscape is constantly evolving, requiring banks to comply with new rules and regulations, which can be complex and costly.

Q: How can banks prepare for the trends in the banking industry 2025?

A: Banks can prepare for the trends in the banking industry 2025 by:

- Investing in technology: Embracing new technologies, such as AI, ML, blockchain, and cloud computing, is crucial for banks to remain competitive and meet customer expectations.

- Developing digital banking platforms: Banks need to prioritize digital banking experiences, offering user-friendly mobile apps, online banking platforms, and seamless digital onboarding processes.

- Partnering with fintech companies: Collaborating with fintech companies can provide banks with access to innovative technologies and solutions, enhancing their offerings and expanding their reach.

- Prioritizing cybersecurity: Banks must invest in robust cybersecurity measures, implement strict data protection protocols, and educate employees about cybersecurity best practices.

- Embracing sustainability: Integrating ESG factors into their business practices can enhance the reputation of banks and attract customers who value sustainability.

Q: What is the impact of these trends on consumers?

A: The trends in the banking industry 2025 have a significant impact on consumers, offering them:

- Greater control over their finances: Open banking empowers consumers to share their financial data with third-party applications, providing them with greater control over their finances.

- Personalized financial services: AI-powered tools and data analytics enable banks to offer tailored financial products and services that cater to individual needs and preferences.

- Improved accessibility to financial services: Fintech companies and digital banking platforms are expanding access to financial services for underserved populations.

- Enhanced security and fraud prevention: Cybersecurity measures and AI-powered fraud detection systems protect consumers from unauthorized access and financial crimes.

- More sustainable financial options: Sustainable banking practices offer consumers the opportunity to support businesses and financial institutions that prioritize environmental and social responsibility.

Tips

- Stay informed about the latest trends in the banking industry: Follow industry publications, attend conferences, and engage with thought leaders to stay up-to-date on the latest trends and innovations.

- Embrace digital banking solutions: Utilize mobile banking apps, online banking platforms, and digital onboarding processes to take advantage of the convenience and efficiency of digital banking.

- Explore open banking opportunities: Leverage open banking to access innovative financial products and services that cater to your needs and preferences.

- Prioritize cybersecurity: Protect your financial data by using strong passwords, enabling two-factor authentication, and being cautious of phishing scams.

- Support sustainable banking practices: Choose banks and financial institutions that prioritize sustainability and social responsibility.

Conclusion

The banking industry is on the cusp of a significant transformation driven by technology, evolving customer expectations, and a dynamic regulatory landscape. Understanding the trends in the banking industry 2025 is crucial for banks, financial institutions, and consumers alike. By embracing innovation, prioritizing customer needs, and adapting to the changing environment, the industry can navigate these trends and create a more efficient, inclusive, and sustainable financial ecosystem.

Closure

Thus, we hope this article has provided valuable insights into The Future of Banking: Navigating Trends in the Banking Industry 2025. We hope you find this article informative and beneficial. See you in our next article!