Navigating the Future: Understanding Mortgage Rate Trends Graph 2025

Related Articles: Navigating the Future: Understanding Mortgage Rate Trends Graph 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: Understanding Mortgage Rate Trends Graph 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Future: Understanding Mortgage Rate Trends Graph 2025

- 2 Introduction

- 3 Navigating the Future: Understanding Mortgage Rate Trends Graph 2025

- 3.1 The Influence of Economic Factors on Mortgage Rates

- 3.2 Historical Trends and Forecasting Models

- 3.3 Mortgage Rate Trends Graph 2025: A Glimpse into the Future

- 3.4 Related Searches: Exploring the Nuances of Mortgage Rates

- 3.5 FAQs: Addressing Common Questions about Mortgage Rate Trends Graph 2025

- 3.6 Tips for Navigating Mortgage Rate Trends Graph 2025

- 3.7 Conclusion: Embracing the Future of Homeownership

- 4 Closure

Navigating the Future: Understanding Mortgage Rate Trends Graph 2025

Predicting the future of mortgage rates is a complex endeavor, influenced by a myriad of economic factors. However, analyzing historical trends and current economic conditions can provide valuable insights into potential mortgage rate trends graph 2025. This exploration aims to demystify the intricacies of mortgage rate movements, equipping individuals with the knowledge to make informed decisions regarding their homeownership aspirations.

The Influence of Economic Factors on Mortgage Rates

Mortgage rates are inextricably linked to broader economic forces. The Federal Reserve’s monetary policy, inflation rates, and overall economic growth play pivotal roles in shaping the direction of mortgage rates.

- Federal Reserve Monetary Policy: The Federal Reserve, often referred to as the Fed, is the central bank of the United States. The Fed’s primary objective is to maintain price stability and full employment. To achieve these goals, the Fed manipulates interest rates through a process known as monetary policy. When the Fed wants to stimulate economic growth, it lowers interest rates, making it cheaper to borrow money. Conversely, when the Fed seeks to curb inflation, it raises interest rates, making borrowing more expensive.

- Inflation: Inflation refers to the general increase in prices for goods and services over time. When inflation is high, the purchasing power of money diminishes, and lenders demand higher interest rates to compensate for the erosion of their capital. Conversely, low inflation typically leads to lower interest rates.

- Economic Growth: Strong economic growth usually translates to higher demand for loans, including mortgages. This increased demand can push mortgage rates upward. Conversely, sluggish economic growth can lead to lower demand and potentially lower rates.

Historical Trends and Forecasting Models

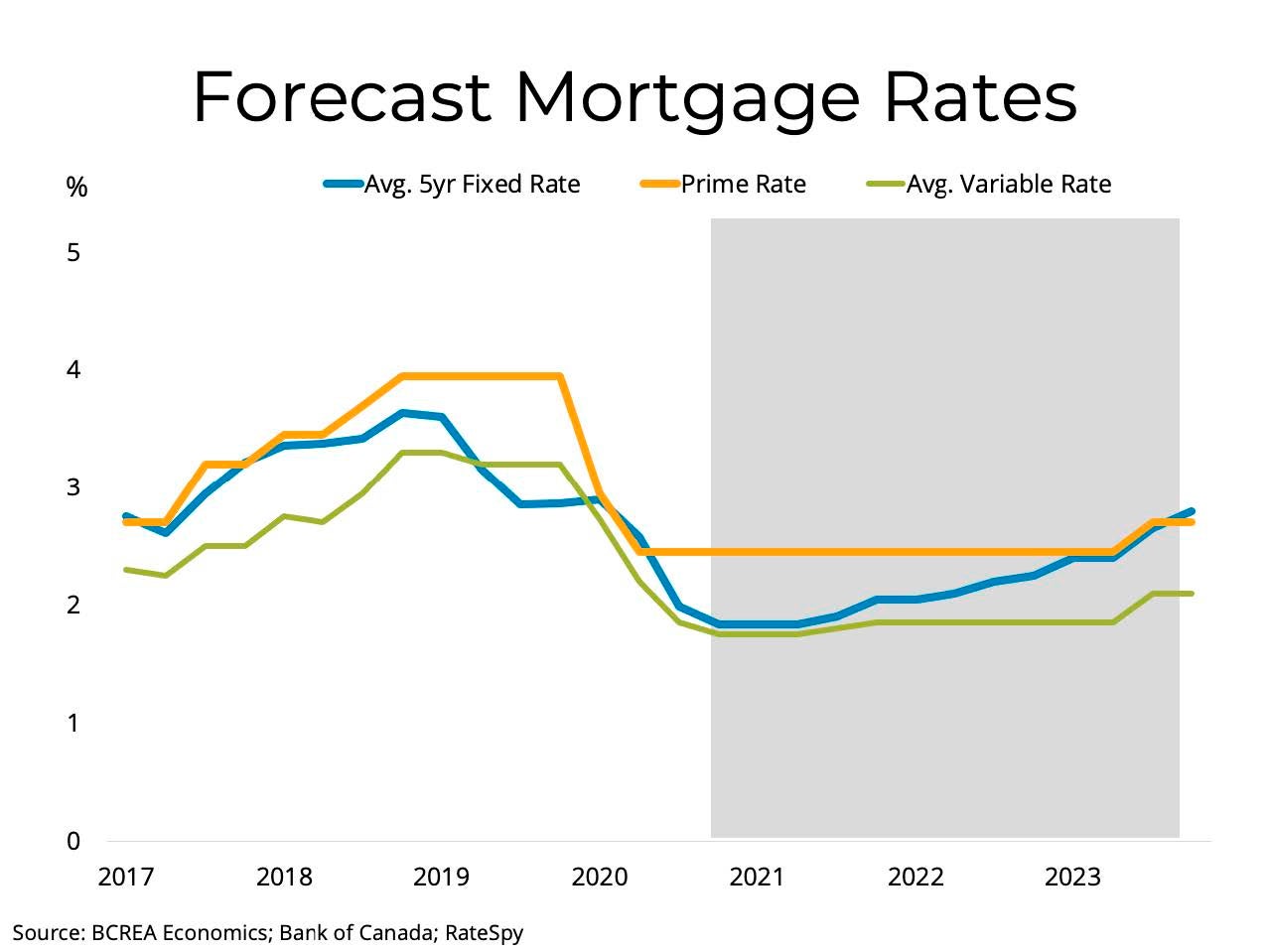

Analyzing historical mortgage rate trends graph 2025 reveals cyclical patterns influenced by economic events.

- The Great Recession: The period between 2007 and 2009 witnessed a significant decline in mortgage rates as the Fed implemented measures to stimulate the economy. Rates reached historic lows, making homeownership more accessible.

- Post-Recession Recovery: Following the recession, mortgage rates gradually rose as the economy recovered and the Fed began to normalize interest rates.

- The Pandemic Era: The COVID-19 pandemic initially triggered a sharp drop in mortgage rates as the Fed injected liquidity into the financial system. However, as the economy rebounded, rates began to climb again, reaching multi-year highs in 2022.

Forecasting models utilize historical data, economic indicators, and statistical techniques to predict future trends. These models can provide valuable insights, but it’s crucial to understand their limitations. Economic conditions are inherently unpredictable, and unforeseen events can significantly impact rate projections.

Mortgage Rate Trends Graph 2025: A Glimpse into the Future

While predicting the future with absolute certainty is impossible, several factors suggest potential mortgage rate trends graph 2025.

- Inflationary Pressures: The current high inflation rate poses challenges for the Fed, potentially leading to continued interest rate hikes. This could result in higher mortgage rates in the short term.

- Economic Uncertainty: Global economic uncertainties, including geopolitical tensions and supply chain disruptions, can influence investor sentiment and impact mortgage rates.

- Housing Market Dynamics: The demand for housing remains strong, but rising interest rates have slowed down the pace of home sales. The interplay between supply and demand will play a significant role in shaping future mortgage rates.

While predicting the exact trajectory of mortgage rates is challenging, several scenarios are possible:

- Scenario 1: Gradual Rise: Mortgage rates could gradually rise throughout 2025, reflecting the Fed’s efforts to curb inflation and stabilize the economy.

- Scenario 2: Stabilization: Mortgage rates could stabilize around current levels, with the Fed balancing its inflation concerns with the need to avoid stifling economic growth.

- Scenario 3: Unexpected Volatility: Unforeseen economic events, such as a recession or a sudden shift in investor sentiment, could cause significant volatility in mortgage rates.

Related Searches: Exploring the Nuances of Mortgage Rates

Understanding mortgage rate trends graph 2025 requires exploring related concepts and factors that influence the broader mortgage market.

1. Fixed vs. Adjustable-Rate Mortgages (ARMs):

- Fixed-Rate Mortgages: Offer a fixed interest rate for the duration of the loan, providing predictability and stability in monthly payments.

- Adjustable-Rate Mortgages (ARMs): Feature an interest rate that adjusts periodically based on a benchmark index, such as the LIBOR (London Interbank Offered Rate). ARMs can offer lower initial rates but carry the risk of higher payments in the future.

2. Mortgage Points:

- Mortgage Points: Are upfront fees paid to a lender in exchange for a lower interest rate. Each point typically equals 1% of the loan amount.

- Benefits of Points: Lowering monthly payments, reducing overall interest costs, and potentially shortening the loan term.

- Considerations: Points can be expensive, and the savings might not outweigh the upfront cost, depending on the loan term and interest rate.

3. Prepayment Penalties:

- Prepayment Penalties: Are fees imposed by lenders if borrowers repay their mortgage loan early.

- Impact on Borrowers: Can discourage early repayment and potentially increase the overall cost of borrowing.

- Importance of Understanding: Carefully review loan documents to understand the prepayment penalty terms, if any.

4. Mortgage Insurance:

- Mortgage Insurance: Protects lenders against losses if a borrower defaults on their loan.

- Types of Mortgage Insurance: Private Mortgage Insurance (PMI) for conventional loans and FHA mortgage insurance for FHA-backed loans.

- Eligibility: Typically required for loans with a low down payment, offering borrowers with limited equity the opportunity to secure financing.

5. Mortgage Rates by State:

- Variations in Rates: Mortgage rates can fluctuate across different states due to factors such as local housing markets, economic conditions, and lender competition.

- Importance of Comparison: Researching rates from multiple lenders in your state is crucial to finding the best deal.

6. Impact of Interest Rates on Housing Affordability:

- Higher Rates: Make homeownership more expensive, potentially reducing the number of qualified buyers.

- Lower Rates: Increase affordability, stimulating demand in the housing market.

- Importance of Understanding: The relationship between interest rates and housing affordability is critical for understanding the overall health of the housing market.

7. The Role of the Federal Housing Administration (FHA):

- FHA-Backed Loans: Offer more flexible loan terms and lower down payment requirements compared to conventional loans.

- Impact on Borrowers: Provide access to homeownership for individuals with limited credit history or down payment funds.

8. Mortgage Rate Trends Graph 2025: Long-Term Perspective:

- Historical Trends: Examining historical mortgage rate trends graph 2025 provides context for understanding long-term patterns.

- Economic Cycles: The economy experiences cyclical fluctuations, influencing mortgage rates over time.

- Importance of Perspective: Taking a long-term perspective can help mitigate short-term fluctuations and make informed decisions regarding homeownership.

FAQs: Addressing Common Questions about Mortgage Rate Trends Graph 2025

1. What factors influence mortgage rates in 2025?

Mortgage rates in 2025 will be influenced by a complex interplay of factors, including:

- Federal Reserve Monetary Policy: The Fed’s actions to control inflation and stimulate economic growth will significantly impact interest rates.

- Inflation: High inflation can lead to higher interest rates as lenders seek to protect their capital against erosion.

- Economic Growth: Strong economic growth can increase demand for loans, potentially pushing mortgage rates upward.

- Global Economic Conditions: International events and uncertainties can influence investor sentiment and impact mortgage rates.

- Housing Market Dynamics: The supply and demand for housing will play a role in shaping mortgage rates.

2. How do I predict mortgage rate trends graph 2025?

Predicting mortgage rate trends graph 2025 with absolute certainty is impossible. However, analyzing historical trends, economic indicators, and consulting with financial experts can provide valuable insights.

3. Should I wait for lower rates before buying a house?

Waiting for lower rates can be a strategic approach, but it involves risks. If rates remain high or even rise further, the opportunity cost of waiting could be significant. Consider your financial goals, housing market conditions, and individual circumstances when making this decision.

4. What is the best mortgage type for me in 2025?

The best mortgage type depends on your individual financial situation, risk tolerance, and long-term plans.

- Fixed-rate mortgages: Offer stability and predictability but may have higher initial rates.

- Adjustable-rate mortgages (ARMs): Can provide lower initial rates but carry the risk of higher payments in the future.

Consult with a mortgage professional to determine the best option for your specific needs.

5. How can I find the best mortgage rate in 2025?

Finding the best mortgage rate involves:

- Comparing rates from multiple lenders: Shop around and compare offers from different institutions.

- Considering loan terms and fees: Evaluate the overall cost of borrowing, including interest rates, points, and closing costs.

- Checking your credit score: A higher credit score typically qualifies you for lower interest rates.

- Utilizing online mortgage calculators: Use online tools to estimate monthly payments and compare different loan scenarios.

Tips for Navigating Mortgage Rate Trends Graph 2025

- Stay Informed: Regularly monitor economic news and financial reports to understand the factors influencing mortgage rates.

- Consult with a Financial Advisor: Seek guidance from a qualified professional to develop a personalized financial plan and explore mortgage options.

- Consider Your Financial Goals: Determine your long-term financial objectives and align your mortgage decisions accordingly.

- Maintain a Strong Credit Score: A good credit score can significantly improve your chances of securing favorable loan terms.

- Be Prepared for Rate Fluctuations: Recognize that mortgage rates are subject to change and be ready to adapt your plans as needed.

Conclusion: Embracing the Future of Homeownership

The mortgage rate trends graph 2025 is a dynamic landscape shaped by a multitude of economic forces. Understanding the factors that influence rate movements empowers individuals to make informed decisions regarding their homeownership aspirations. By staying informed, seeking professional guidance, and adopting a flexible approach, individuals can navigate the complexities of the mortgage market and achieve their homeownership goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Understanding Mortgage Rate Trends Graph 2025. We appreciate your attention to our article. See you in our next article!