Navigating the Future: How to Identify Stock Trends for 2025

Related Articles: Navigating the Future: How to Identify Stock Trends for 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: How to Identify Stock Trends for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: How to Identify Stock Trends for 2025

The stock market, a complex and dynamic entity, is often viewed as a daunting maze for the uninitiated. However, understanding the underlying trends can pave the way for informed investment decisions. Looking ahead to 2025, it is crucial to identify the forces shaping the market and the sectors poised for growth. This article delves into the key factors influencing stock trends and provides a comprehensive guide on how to navigate this evolving landscape.

Understanding the Drivers of Stock Trends

Stock trends are not arbitrary occurrences; they are shaped by a confluence of economic, technological, societal, and political factors. To effectively identify potential trends, it is essential to understand these drivers:

-

Economic Growth and Interest Rates: Economic growth, measured by GDP, is a significant driver of stock market performance. A robust economy typically translates to higher corporate earnings and increased investor confidence. Conversely, slowing economic growth or rising interest rates can dampen investor enthusiasm, potentially leading to market corrections.

-

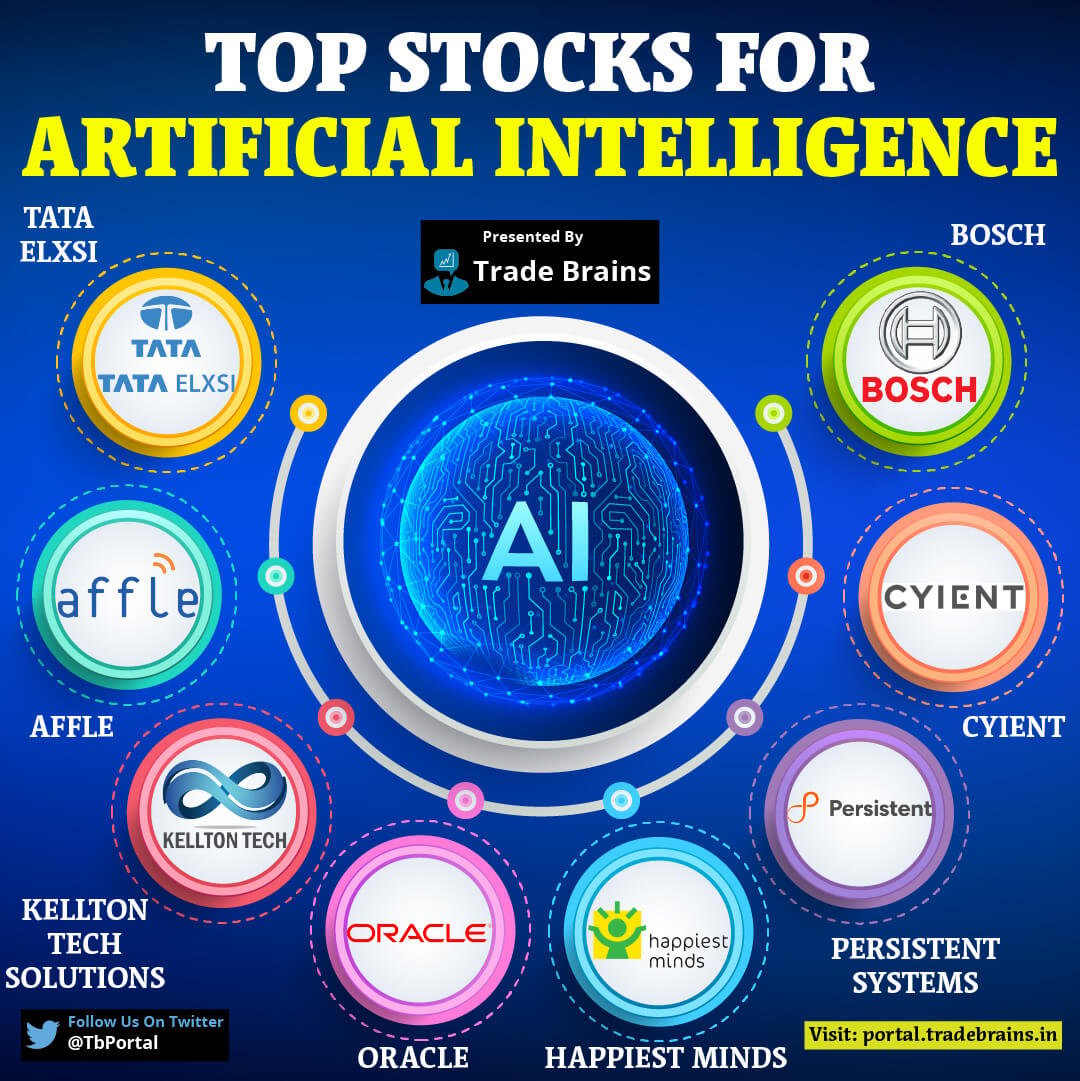

Technological Advancements: Technological innovations are a constant disruptor, creating new industries and transforming existing ones. Artificial Intelligence (AI), blockchain technology, and the rise of the Metaverse are just a few examples of disruptive forces that are likely to shape the stock market in the years to come.

-

Demographic Shifts: Population trends, including aging demographics, urbanization, and changing consumer preferences, have a profound impact on industries and companies. Understanding these shifts can provide insights into sectors that are likely to experience growth or decline in the future.

-

Geopolitical Events: Geopolitical events, such as trade wars, political instability, and global conflicts, can significantly influence stock markets. These events can create uncertainty and volatility, impacting investor sentiment and market direction.

Key Strategies for Identifying Stock Trends for 2025

Now that we have identified the key drivers, let’s explore actionable strategies for identifying potential stock trends for 2025:

-

Industry Analysis:

- Emerging Technologies: Invest time in researching sectors driven by emerging technologies. This includes AI, robotics, cybersecurity, renewable energy, and biotech. These sectors are poised for significant growth as they address pressing global challenges and create new opportunities.

- Sustainable Investing: Environmental, social, and governance (ESG) factors are gaining increasing importance among investors. Companies with strong ESG credentials are likely to attract more capital, particularly as investors prioritize sustainability and ethical practices.

- Healthcare Innovations: The healthcare industry is constantly evolving with advancements in genomics, personalized medicine, and digital health. Companies focused on these areas have the potential to benefit from the growing demand for innovative healthcare solutions.

-

Macroeconomic Analysis:

- Global Economic Outlook: Stay informed about global economic forecasts, particularly regarding growth rates, inflation, and interest rate policies. These factors can provide valuable insights into the overall direction of the stock market.

- Inflation and Interest Rates: Monitor inflation rates and central bank policies, as these factors can impact corporate earnings and investor sentiment. Rising inflation can lead to higher interest rates, which can make borrowing more expensive and potentially slow economic growth.

- Currency Fluctuations: Currency exchange rates can impact the performance of companies with significant international operations. Pay attention to currency trends and their potential impact on specific sectors and companies.

-

Company-Specific Analysis:

- Fundamental Analysis: Focus on the financial health of individual companies, analyzing their balance sheets, income statements, and cash flow statements. Look for companies with strong earnings growth, solid financial positions, and competitive advantages.

- Management Quality: Assess the quality of a company’s management team. Experienced and visionary leaders can drive growth and create shareholder value. Look for companies with transparent and ethical management practices.

- Competitive Landscape: Evaluate a company’s position within its industry. Strong competitive advantages, such as brand recognition, market share, or intellectual property, can help a company outperform its peers.

-

Market Sentiment Analysis:

- News and Media Monitoring: Stay updated on news and media coverage related to the stock market and specific companies. News reports can provide insights into investor sentiment, market trends, and upcoming events.

- Social Media Sentiment: Monitor social media platforms for mentions of specific companies and sectors. Social media sentiment can be a valuable indicator of public perception and potential market movements.

- Investor Forums and Blogs: Engage with online communities and forums where investors discuss market trends, company performance, and investment strategies. These platforms can provide valuable perspectives and insights from experienced investors.

Related Searches:

1. Stock Market Trends 2025

- This search term is a broad inquiry, and the results will likely include articles and reports on various macroeconomic factors, industry trends, and specific sectors expected to perform well in 2025.

2. Top Stock Picks for 2025

- This search term focuses on specific investment recommendations. Results will likely include lists of stocks, sectors, or ETFs that analysts believe will outperform the market in 2025.

3. Stock Market Predictions 2025

- This search term seeks predictions about the overall direction of the stock market. Results will likely include forecasts from economists, analysts, and market commentators about potential market movements and key factors influencing the market.

4. How to Invest in Stock Trends for 2025

- This search term seeks guidance on specific investment strategies for capitalizing on stock trends in 2025. Results will likely include articles on portfolio diversification, asset allocation, and specific investment strategies for different risk profiles.

5. Stock Market Analysis Tools for 2025

- This search term focuses on software and tools that can assist investors in analyzing market data and identifying trends. Results will likely include reviews of financial analysis platforms, stock screening tools, and data visualization software.

6. Best Stocks to Buy in 2025

- This search term aims to identify specific stocks that are considered good investments for 2025. Results will likely include lists of stocks, sectors, or ETFs that analysts believe have strong growth potential.

7. Stock Market Outlook 2025

- This search term seeks a broader perspective on the stock market’s future. Results will likely include articles and reports on economic forecasts, geopolitical risks, and potential market scenarios for 2025.

8. Stock Market Trends 2025: A Comprehensive Guide

- This search term signifies a desire for a detailed and comprehensive guide on understanding stock trends for 2025. Results will likely include in-depth articles covering multiple aspects of market analysis, investment strategies, and risk management.

FAQs on Identifying Stock Trends for 2025

Q: What are the most important factors to consider when identifying stock trends for 2025?

A: The most important factors include economic growth, interest rates, technological advancements, demographic shifts, and geopolitical events. Understanding these factors can provide insights into the industries and companies likely to experience growth or decline in the future.

Q: How can I stay informed about emerging technologies and their impact on the stock market?

A: Stay updated on industry publications, research reports, and news articles focusing on technological advancements. Attend industry conferences and webinars to gain insights from experts and thought leaders.

Q: What are some key indicators to watch for when analyzing the global economic outlook?

A: Monitor GDP growth rates, inflation rates, unemployment rates, and central bank policies. These indicators can provide valuable insights into the overall health of the global economy and its potential impact on stock markets.

Q: How can I assess the quality of a company’s management team?

A: Review the company’s annual reports, investor presentations, and media coverage to gain insights into the management team’s experience, track record, and communication style. Look for companies with transparent and ethical leadership practices.

Q: What are some tools and resources for analyzing market sentiment and identifying potential stock trends?

A: Utilize financial news websites, social media analytics tools, investor forums, and stock screening platforms to monitor market sentiment, news flow, and investor discussions.

Tips for Identifying Stock Trends for 2025

- Diversify your investment portfolio: Don’t put all your eggs in one basket. Diversify your investments across different sectors, industries, and asset classes to mitigate risk.

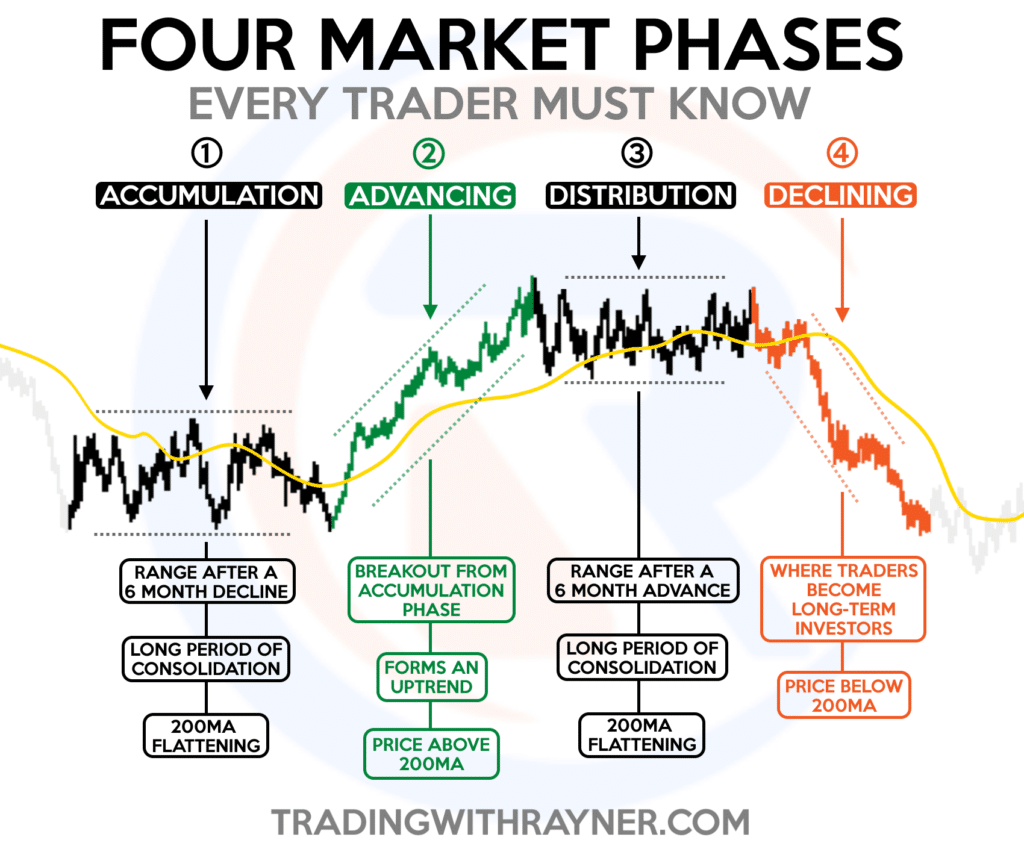

- Invest for the long term: Stock markets are cyclical. Avoid making short-term trading decisions based on speculation or market noise. Focus on investing in companies with strong fundamentals and long-term growth potential.

- Stay disciplined and patient: The stock market can be volatile. Don’t panic sell when the market dips. Stay disciplined with your investment strategy and be patient with your investments.

- Seek professional advice: If you are unsure about how to identify stock trends or invest in the market, consider seeking advice from a qualified financial advisor.

Conclusion

Identifying stock trends for 2025 requires a comprehensive approach that considers multiple factors, including economic growth, technological advancements, and geopolitical events. By staying informed, conducting thorough research, and utilizing appropriate tools and resources, investors can navigate the complexities of the stock market and make informed decisions. Remember, investing involves inherent risks, and past performance is not indicative of future results. Always conduct your own due diligence and seek professional advice when necessary. The journey to successful investing starts with understanding the forces shaping the market and embracing a proactive and informed approach.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: How to Identify Stock Trends for 2025. We thank you for taking the time to read this article. See you in our next article!