Navigating the Future: Financial Service Industry Trends in 2025

Related Articles: Navigating the Future: Financial Service Industry Trends in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: Financial Service Industry Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Financial Service Industry Trends in 2025

The financial services industry is in a constant state of flux, driven by technological advancements, evolving customer expectations, and shifts in the global economic landscape. Looking ahead to 2025, several key trends are poised to reshape the industry, impacting how financial institutions operate, how consumers engage with their finances, and the overall structure of the market.

Financial Service Industry Trends 2025 will be defined by a convergence of factors, including:

- Hyper-Personalization: Tailoring financial products and services to individual needs and preferences will become the norm. This will require leveraging data analytics and artificial intelligence (AI) to understand customer behavior, financial goals, and risk tolerance.

- The Rise of Open Finance: Data sharing and interoperability will become increasingly prevalent, allowing consumers to control and manage their financial data across multiple platforms. This will empower consumers with greater choice and transparency, while also presenting opportunities for financial institutions to develop innovative solutions.

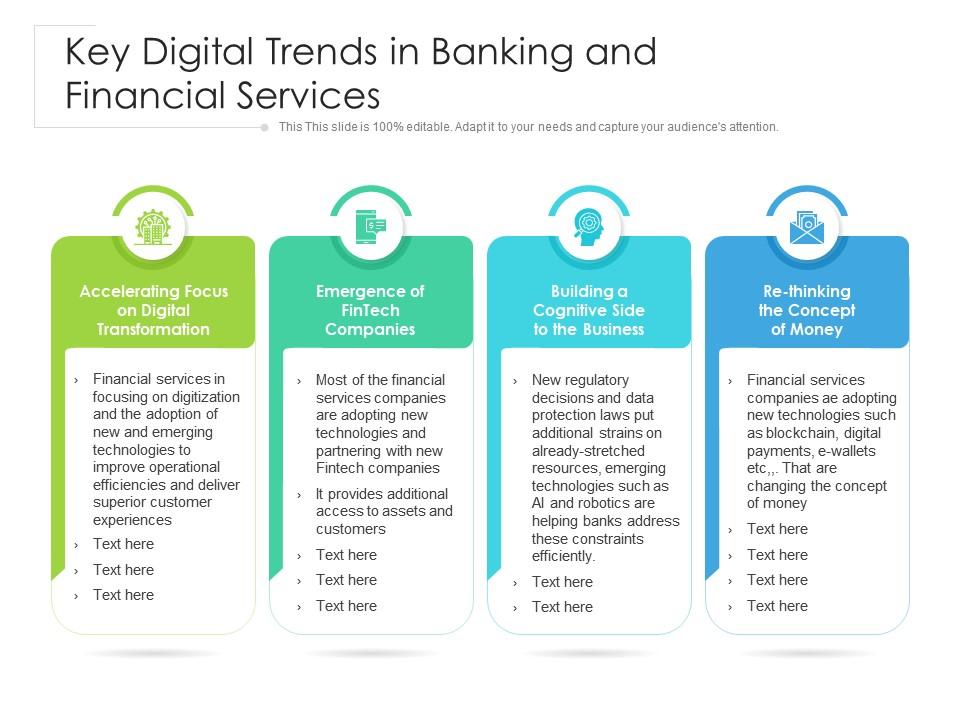

- The Integration of Fintech: Financial technology (fintech) companies will continue to disrupt traditional financial services, offering innovative solutions in areas such as payments, lending, and investment management. Traditional financial institutions will need to embrace collaboration and partnerships with fintech companies to remain competitive.

- The Growing Importance of Sustainability: Environmental, social, and governance (ESG) considerations will become increasingly important for investors and consumers. Financial institutions will need to align their products and services with sustainable practices and demonstrate their commitment to responsible investing.

- The Evolution of Customer Experience: Consumers will expect seamless and personalized digital experiences, with a focus on mobile-first accessibility and 24/7 availability. Financial institutions will need to invest in user-friendly digital platforms and provide exceptional customer service to meet these expectations.

- The Impact of Regulatory Changes: Global regulatory landscapes are evolving, with increased scrutiny on data privacy, cybersecurity, and anti-money laundering measures. Financial institutions will need to adapt their operations and compliance procedures to meet these evolving regulations.

- The Rise of Decentralized Finance (DeFi): Blockchain technology and decentralized finance (DeFi) are gaining traction, offering alternative financial services with greater transparency and control for consumers. While still in its early stages, DeFi has the potential to disrupt traditional financial systems and create new opportunities for financial institutions.

- The Growing Importance of Cybersecurity: Cybersecurity threats are becoming increasingly sophisticated, making it crucial for financial institutions to invest in robust security measures to protect sensitive data and customer information.

Exploring Related Searches:

1. The Future of Banking: The banking industry is undergoing a significant transformation, driven by technological advancements, changing customer expectations, and increased competition from fintech companies.

2. The Future of Investment Management: The investment management industry is evolving rapidly, with a growing focus on personalized investment advice, robo-advisory services, and alternative investments.

3. The Future of Insurance: The insurance industry is adapting to changing risk profiles, evolving customer expectations, and the rise of digital insurance platforms.

4. The Future of Payments: The payments landscape is becoming increasingly complex, with the emergence of new payment methods, such as mobile wallets and cryptocurrency.

5. The Future of Data Analytics in Finance: Data analytics is playing an increasingly critical role in the financial services industry, enabling institutions to make better decisions, improve risk management, and enhance customer experiences.

6. The Future of Artificial Intelligence in Finance: Artificial intelligence (AI) is transforming the financial services industry, automating tasks, improving decision-making, and enhancing customer interactions.

7. The Future of Blockchain in Finance: Blockchain technology is revolutionizing the financial services industry, enabling secure and transparent transactions, streamlining processes, and creating new financial products.

8. The Future of Financial Regulation: Global regulatory landscapes are evolving, with increased scrutiny on data privacy, cybersecurity, and anti-money laundering measures. Financial institutions will need to adapt their operations and compliance procedures to meet these evolving regulations.

Frequently Asked Questions:

Q: What are the biggest challenges facing the financial services industry in 2025?

A: The financial services industry faces several challenges in 2025, including:

- Keeping pace with technological advancements: The rapid pace of technological innovation requires financial institutions to constantly adapt and invest in new technologies to remain competitive.

- Meeting evolving customer expectations: Consumers are demanding more personalized, convenient, and transparent financial services, putting pressure on institutions to enhance their offerings and customer experiences.

- Managing cybersecurity risks: Cybersecurity threats are becoming increasingly sophisticated, requiring financial institutions to invest in robust security measures to protect sensitive data and customer information.

- Navigating regulatory changes: Global regulatory landscapes are evolving, with increased scrutiny on data privacy, cybersecurity, and anti-money laundering measures. Financial institutions will need to adapt their operations and compliance procedures to meet these evolving regulations.

- Competing with fintech companies: Fintech companies are disrupting traditional financial services, offering innovative solutions and challenging the status quo.

Q: What are the key opportunities for financial institutions in 2025?

A: The financial services industry presents several opportunities for growth and innovation in 2025, including:

- Leveraging data analytics and AI: Financial institutions can use data analytics and AI to personalize customer experiences, improve risk management, and develop new products and services.

- Embracing open finance: Open finance enables financial institutions to develop innovative solutions and offer more value to consumers by leveraging data sharing and interoperability.

- Partnering with fintech companies: Collaboration with fintech companies can provide access to innovative technologies and solutions, enabling financial institutions to stay ahead of the curve.

- Focusing on sustainability: Financial institutions can attract investors and customers by aligning their products and services with sustainable practices and demonstrating their commitment to responsible investing.

- Investing in cybersecurity: Robust cybersecurity measures are essential for protecting sensitive data and customer information, building trust, and maintaining a competitive edge.

Tips for Financial Institutions in 2025:

- Embrace digital transformation: Invest in user-friendly digital platforms, mobile-first accessibility, and 24/7 availability to meet evolving customer expectations.

- Prioritize data privacy and security: Implement robust cybersecurity measures to protect sensitive data and customer information, complying with evolving regulations.

- Foster innovation and collaboration: Embrace partnerships with fintech companies and explore new technologies, such as blockchain and AI, to develop innovative solutions.

- Focus on customer experience: Provide personalized and seamless digital experiences, offering exceptional customer service and tailored solutions.

- Embrace sustainability: Align products and services with ESG principles, demonstrating a commitment to responsible investing and sustainable practices.

Conclusion:

Financial Service Industry Trends 2025 represent a pivotal moment in the industry’s evolution. By embracing technological advancements, adapting to changing customer expectations, and navigating the evolving regulatory landscape, financial institutions can position themselves for success in a dynamic and competitive market. The future of financial services is driven by innovation, collaboration, and a commitment to delivering value to consumers. By understanding and adapting to these trends, financial institutions can navigate the future and create a more sustainable and equitable financial system for all.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Financial Service Industry Trends in 2025. We appreciate your attention to our article. See you in our next article!