Navigating the Future: Bitcoin Trends in 2025

Related Articles: Navigating the Future: Bitcoin Trends in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: Bitcoin Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Future: Bitcoin Trends in 2025

- 2 Introduction

- 3 Navigating the Future: Bitcoin Trends in 2025

- 3.1 Bitcoin Trends in 2025: A Comprehensive Outlook

- 3.2 Related Searches:

- 3.3 FAQs About Bitcoin Trends in 2025:

- 3.4 Tips for Bitcoin Trends in 2025:

- 3.5 Conclusion:

- 4 Closure

Navigating the Future: Bitcoin Trends in 2025

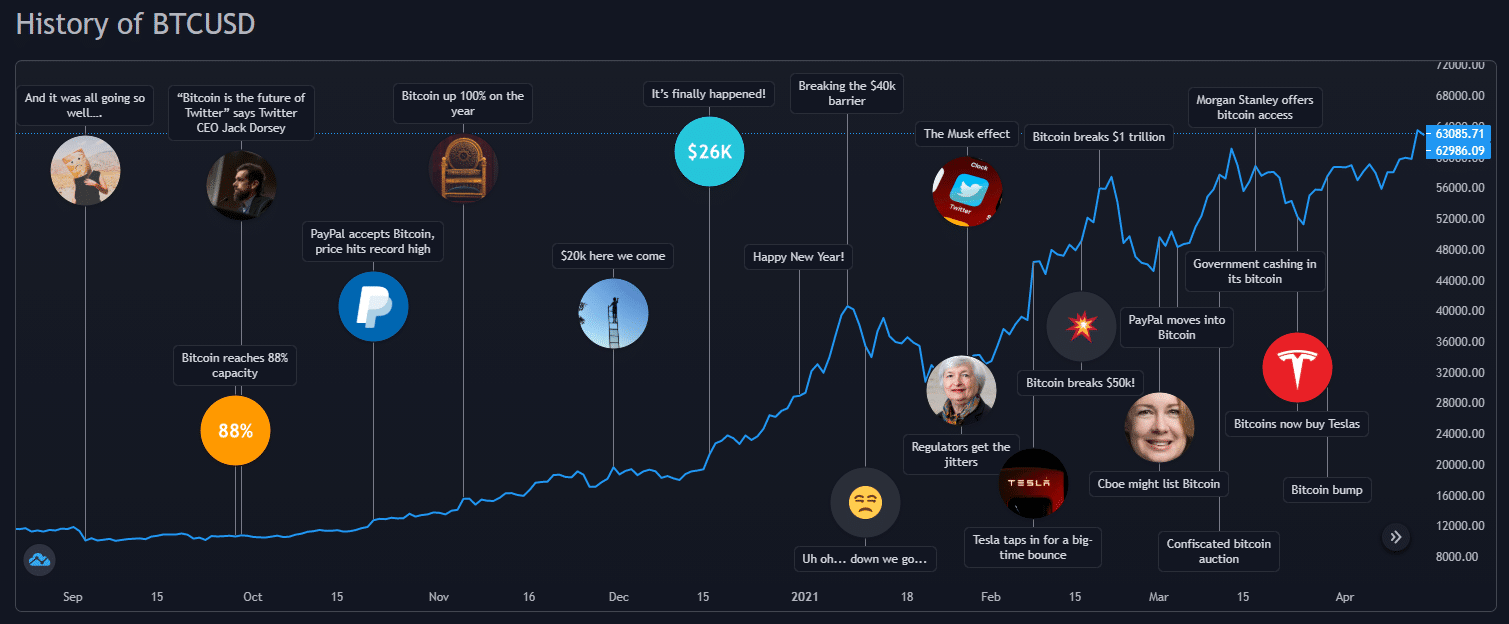

The world of cryptocurrency is constantly evolving, and bitcoin trends in 2025 are expected to be particularly significant. While predictions can be challenging, analyzing current trends and understanding the underlying forces driving the cryptocurrency landscape can provide valuable insights into the potential trajectory of bitcoin in the coming years.

Bitcoin Trends in 2025: A Comprehensive Outlook

1. Regulatory Landscape:

The regulatory landscape surrounding cryptocurrencies is rapidly evolving. Governments and financial institutions are actively working to establish frameworks for the responsible and secure operation of digital assets. Bitcoin trends in 2025 are likely to be shaped by these regulatory developments.

- Increased Clarity and Standardization: Expect to see more comprehensive and standardized regulations for cryptocurrencies, including bitcoin. This could involve licensing requirements for exchanges, anti-money laundering (AML) and know-your-customer (KYC) regulations, and clear tax guidelines.

- Cross-Border Collaboration: International cooperation on cryptocurrency regulation will be crucial to ensure a consistent and harmonized approach. This could involve sharing information and best practices to address issues like cross-border transactions and market manipulation.

- Central Bank Digital Currencies (CBDCs): The rise of CBDCs, digital currencies issued by central banks, could have a significant impact on bitcoin and other cryptocurrencies. The potential for CBDCs to become mainstream payment methods might influence the use cases and value proposition of cryptocurrencies.

2. Institutional Adoption:

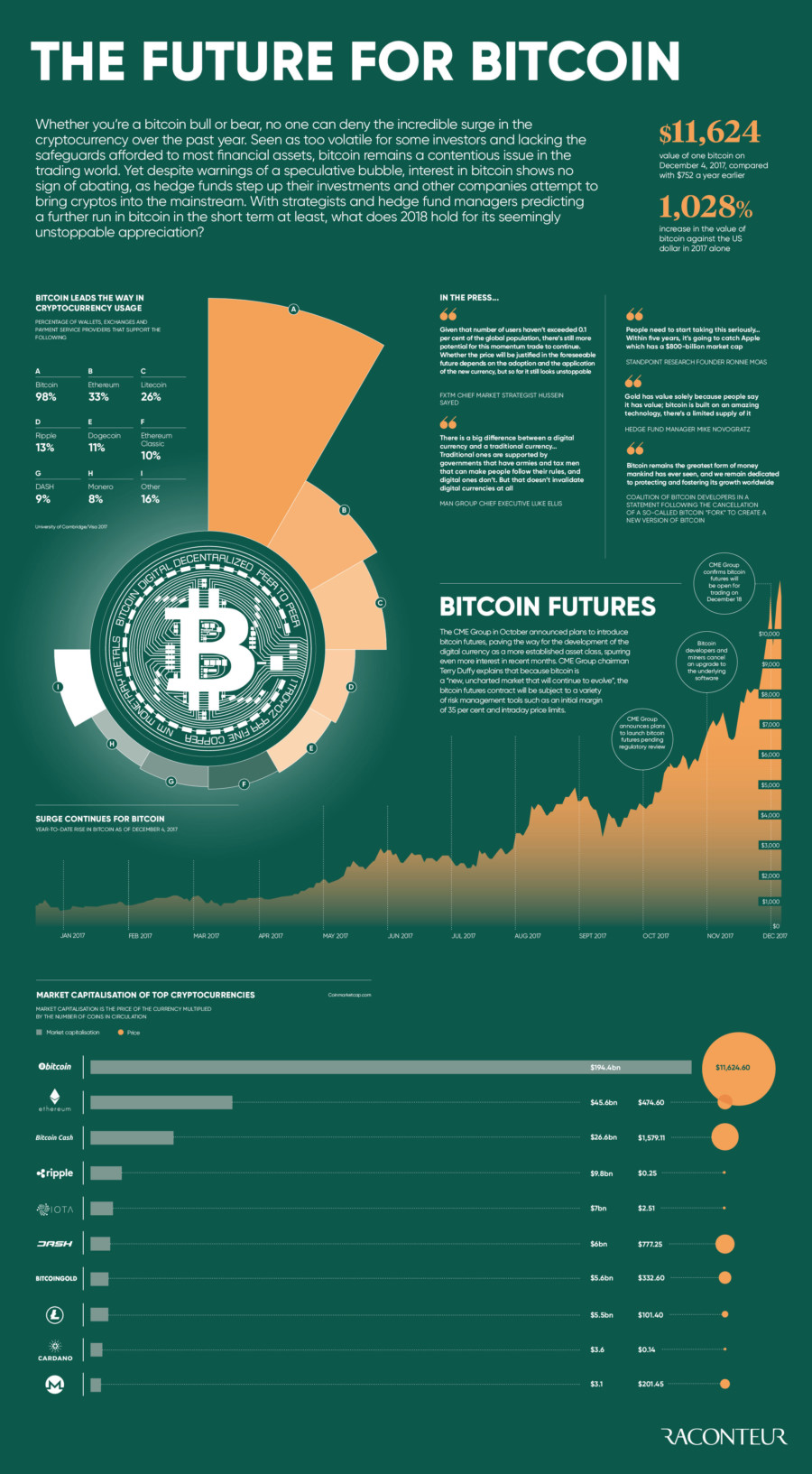

Institutional investors are increasingly embracing cryptocurrencies, particularly bitcoin. This trend is expected to continue, further solidifying bitcoin’s position as a viable asset class.

- Increased Institutional Investments: Expect to see more hedge funds, pension funds, and other institutional investors allocating a portion of their portfolios to bitcoin. This could lead to increased demand and price stability.

- Development of Bitcoin-Based Financial Products: The emergence of bitcoin-based financial products, such as exchange-traded funds (ETFs) and derivatives, will provide investors with more avenues to gain exposure to bitcoin. This could attract a wider range of investors, including those seeking diversification or hedging strategies.

- Integration into Traditional Finance: Bitcoin is gradually becoming integrated into traditional financial systems. This is evident in the growing number of banks and financial institutions offering bitcoin custody services, trading platforms, and other related services.

3. Technological Advancements:

The underlying technology behind bitcoin, blockchain, is constantly evolving. Advancements in scalability, efficiency, and security are expected to drive bitcoin trends in 2025.

- Layer-2 Scaling Solutions: Solutions like Lightning Network and other layer-2 protocols are designed to increase the transaction capacity and speed of bitcoin, making it more suitable for everyday use. These advancements could lead to wider adoption and increased utility.

- Privacy-Enhancing Technologies: The development of privacy-enhancing technologies, such as shielded transactions and zero-knowledge proofs, could address concerns about bitcoin’s transparency and enhance its appeal to users seeking greater privacy.

- Interoperability and Cross-Chain Solutions: The increasing interoperability between different blockchains will enable smoother communication and collaboration between bitcoin and other cryptocurrencies. This could lead to the development of new applications and services that leverage the strengths of various blockchain networks.

4. Global Adoption and Use Cases:

Bitcoin’s use cases are expanding beyond simple digital gold. Its potential as a decentralized payment system, store of value, and tool for financial inclusion is being explored by businesses and individuals worldwide.

- Increased Merchant Adoption: More businesses are likely to accept bitcoin as a payment method, particularly in industries like online retail, travel, and gaming. This would increase bitcoin’s accessibility and utility for everyday transactions.

- Emerging Markets and Financial Inclusion: Bitcoin could play a significant role in promoting financial inclusion in emerging markets with limited access to traditional banking services. Its decentralized nature and low transaction fees can provide an alternative financial infrastructure.

- Decentralized Finance (DeFi): Bitcoin is being integrated into the DeFi ecosystem, enabling users to access lending, borrowing, and other financial services without intermediaries. This could lead to innovative applications and further decentralization of the financial system.

5. Environmental Concerns and Sustainability:

Bitcoin’s energy consumption has been a subject of debate. Bitcoin trends in 2025 are likely to be influenced by efforts to address these concerns and make bitcoin more sustainable.

- Transition to Renewable Energy Sources: The bitcoin mining industry is increasingly adopting renewable energy sources, such as solar and wind power. This shift will help reduce the environmental impact of bitcoin.

- Energy Efficiency Improvements: Technological advancements in mining hardware and software are leading to increased energy efficiency. This could further reduce bitcoin’s energy footprint.

- Alternative Proof-of-Work Consensus Mechanisms: Some proponents are exploring alternative consensus mechanisms, such as proof-of-stake, to reduce bitcoin’s energy consumption. However, such changes would require significant consensus within the bitcoin community.

6. Security and Trust:

Security and trust are crucial for the long-term success of any cryptocurrency. Bitcoin trends in 2025 will be driven by efforts to strengthen security measures and build trust in the bitcoin ecosystem.

- Improved Security Protocols: Ongoing advancements in cryptography and security protocols are expected to enhance bitcoin’s security and resilience against hacking and other threats.

- Enhanced Regulatory Oversight: Increased regulatory oversight will help to mitigate risks associated with fraud, money laundering, and other illicit activities.

- Community Governance and Transparency: The continued emphasis on transparency and community governance will help to build trust and ensure the long-term stability of the bitcoin ecosystem.

7. Social Impact and Adoption:

The social impact of bitcoin and other cryptocurrencies is becoming increasingly apparent. Bitcoin trends in 2025 will reflect the growing understanding of its potential to empower individuals and communities.

- Financial Empowerment: Bitcoin can provide individuals with greater control over their finances, particularly in countries with weak or unstable financial systems.

- Decentralized Governance: Bitcoin’s decentralized nature can promote transparency and accountability in various sectors, from supply chains to voting systems.

- Community Development: Bitcoin is fostering the development of decentralized communities, enabling individuals to collaborate and build new economic models.

8. Innovation and New Applications:

The innovative potential of bitcoin and blockchain technology is constantly being explored. Bitcoin trends in 2025 will be shaped by the emergence of new applications and use cases that leverage the unique capabilities of bitcoin.

- Non-Fungible Tokens (NFTs): Bitcoin’s blockchain technology can be used to create and manage NFTs, digital assets representing ownership of unique items. This could lead to new markets and opportunities in areas like art, gaming, and collectibles.

- Smart Contracts and Decentralized Applications (DApps): Bitcoin’s underlying technology can be used to create smart contracts and DApps, enabling the automation of complex processes and the development of decentralized applications.

- Data Security and Privacy: Bitcoin’s blockchain can be used to secure and store data in a tamper-proof and decentralized manner, potentially revolutionizing data management and privacy protection.

Related Searches:

1. Bitcoin Price Prediction 2025:

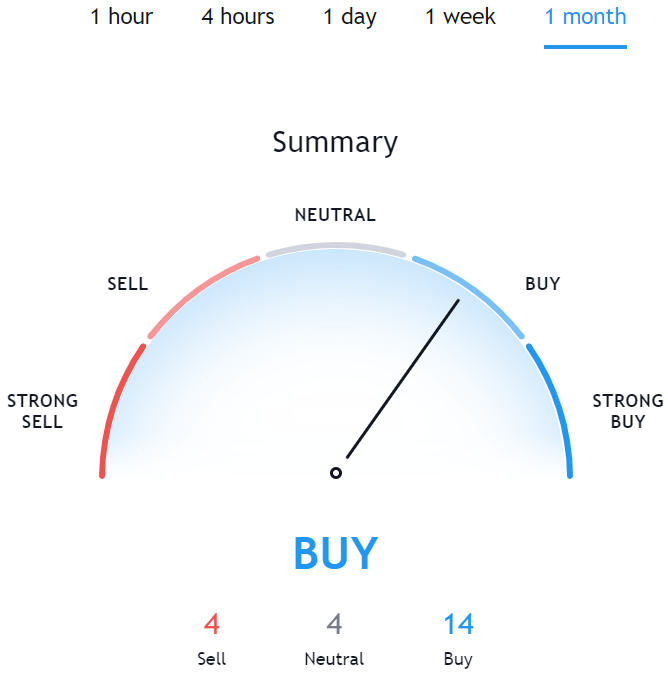

Predicting the future price of bitcoin is a complex task, influenced by various factors, including market sentiment, regulatory developments, and technological advancements. However, analysts often consider historical data, adoption trends, and fundamental factors to estimate potential price movements. While specific price targets can vary, many experts believe bitcoin could reach new highs in 2025.

2. Bitcoin Mining 2025:

Bitcoin mining is the process of verifying and adding transactions to the blockchain. As the network grows, the difficulty of mining increases, requiring specialized hardware and energy consumption. Bitcoin trends in 2025 suggest that mining will likely become even more competitive and energy-intensive. However, advancements in hardware and energy efficiency could mitigate some of these challenges.

3. Bitcoin Halving 2025:

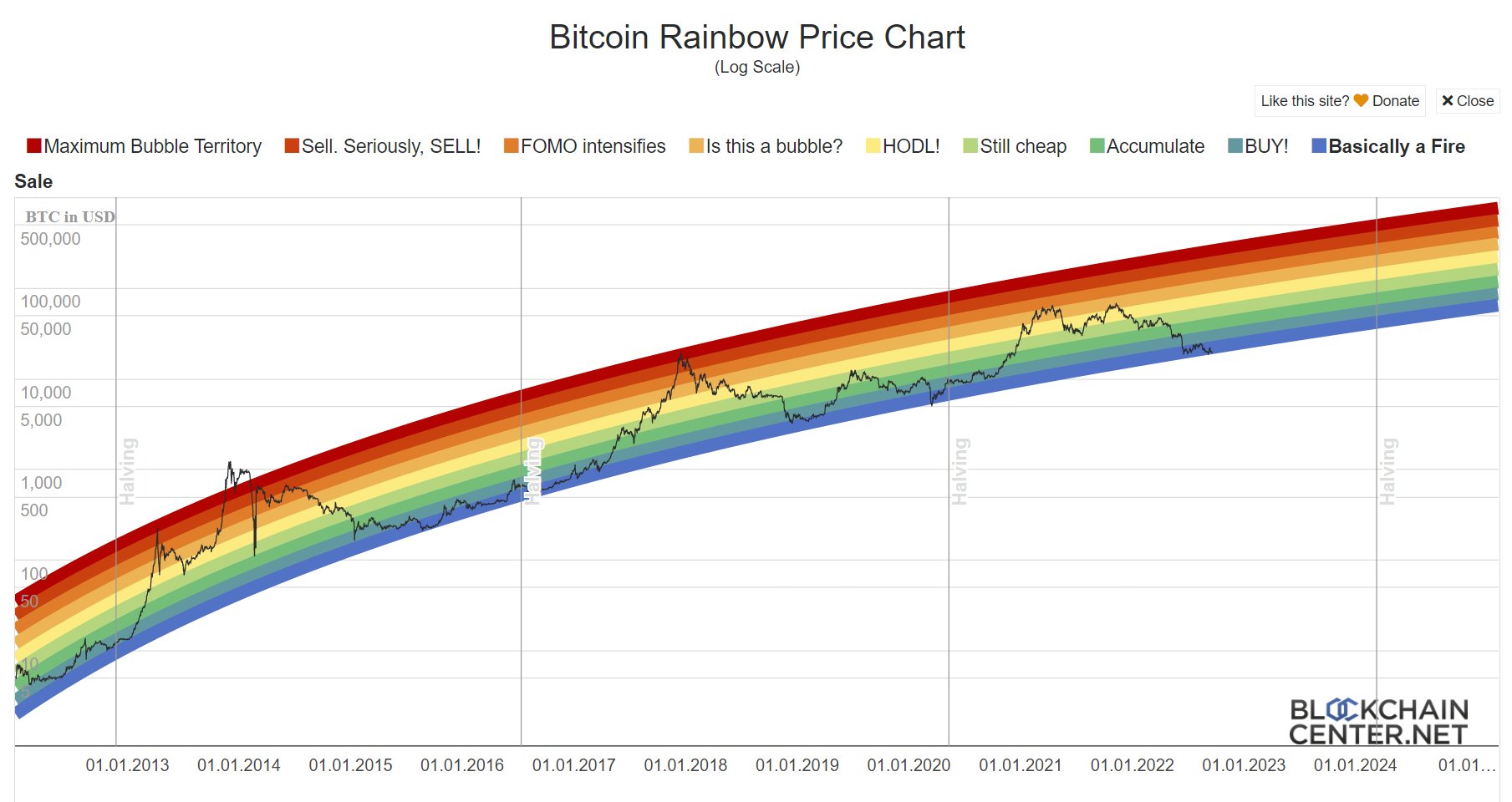

Bitcoin’s halving events occur approximately every four years, reducing the rate at which new bitcoins are created. The next halving is expected in 2024, which could have a significant impact on the supply and demand dynamics of bitcoin. This event could influence bitcoin trends in 2025 by potentially leading to a surge in price as the supply of new bitcoins becomes more limited.

4. Bitcoin ETF 2025:

The availability of bitcoin ETFs (exchange-traded funds) could make it easier for investors to gain exposure to bitcoin through traditional brokerage accounts. Bitcoin trends in 2025 could see a significant increase in the adoption of bitcoin ETFs, potentially leading to greater price stability and liquidity.

5. Bitcoin Volatility 2025:

Bitcoin is known for its volatility, characterized by significant price fluctuations in both directions. Bitcoin trends in 2025 might see a reduction in volatility as the cryptocurrency becomes more mainstream and institutional adoption increases. However, factors like market sentiment and regulatory uncertainty could still contribute to price swings.

6. Bitcoin Adoption 2025:

The adoption of bitcoin is expected to continue growing in 2025. Bitcoin trends in 2025 suggest that more businesses, individuals, and governments will embrace bitcoin as a payment method, store of value, and tool for financial innovation.

7. Bitcoin vs. Ethereum 2025:

Bitcoin and Ethereum are the two largest cryptocurrencies, each with its unique features and use cases. Bitcoin trends in 2025 will likely be influenced by the ongoing competition and collaboration between these two cryptocurrencies. While bitcoin is often seen as a store of value, Ethereum is known for its smart contract capabilities and support for decentralized applications.

8. Bitcoin Future 2025:

The future of bitcoin is uncertain, but its potential impact on the global financial system is significant. Bitcoin trends in 2025 suggest that bitcoin could continue to evolve and play a more prominent role in the future of finance. Its decentralized nature, scarcity, and growing adoption make it a compelling asset for investors and innovators alike.

FAQs About Bitcoin Trends in 2025:

1. Will bitcoin be legal in 2025?

The legal status of bitcoin varies across jurisdictions. Bitcoin trends in 2025 suggest that more countries will likely establish clear regulatory frameworks for cryptocurrencies, including bitcoin. This could lead to greater legal certainty and acceptance.

2. Will bitcoin be worth more in 2025?

Predicting the future price of bitcoin is challenging. Bitcoin trends in 2025 could see the price of bitcoin increase due to factors like institutional adoption, regulatory clarity, and technological advancements. However, other factors, such as market sentiment and economic conditions, could also influence its price.

3. Will bitcoin replace traditional currencies?

It is unlikely that bitcoin will completely replace traditional currencies in the near future. Bitcoin trends in 2025 suggest that bitcoin could become a more widely accepted payment method, but it is likely to coexist with traditional currencies for the foreseeable future.

4. Is bitcoin safe?

Bitcoin is generally considered a secure digital asset. Bitcoin trends in 2025 suggest that security measures will continue to improve, with advancements in cryptography and security protocols. However, it’s important to practice good security practices and store bitcoin in a secure wallet.

5. Is bitcoin a good investment?

Bitcoin is a volatile asset class, and investing in it carries risks. Bitcoin trends in 2025 suggest that bitcoin could offer potential returns, but it’s crucial to conduct thorough research, understand the risks, and invest only what you can afford to lose.

6. How can I buy bitcoin in 2025?

You can buy bitcoin through cryptocurrency exchanges, which allow you to trade bitcoin for fiat currencies or other cryptocurrencies. Bitcoin trends in 2025 suggest that the process of buying bitcoin will become more streamlined and accessible.

7. Is bitcoin a bubble?

The question of whether bitcoin is a bubble is a subject of ongoing debate. Bitcoin trends in 2025 could provide further insights into its long-term sustainability. Factors like institutional adoption, regulatory clarity, and technological advancements could contribute to its stability and growth.

8. What are the benefits of using bitcoin?

Bitcoin offers several potential benefits, including:

- Decentralization: Bitcoin is not controlled by any central authority, making it resistant to censorship and manipulation.

- Security: Bitcoin’s blockchain technology provides a secure and tamper-proof record of transactions.

- Transparency: All bitcoin transactions are publicly auditable, promoting transparency and accountability.

- Global Accessibility: Bitcoin can be sent and received anywhere in the world, facilitating cross-border transactions.

- Low Transaction Fees: Bitcoin transactions typically have low fees compared to traditional payment methods.

Tips for Bitcoin Trends in 2025:

- Stay Informed: Keep up-to-date with the latest developments in the cryptocurrency space, including regulatory changes, technological advancements, and market trends.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes, including traditional and digital assets.

- Practice Good Security Practices: Protect your bitcoin by using strong passwords, two-factor authentication, and secure wallets.

- Invest Wisely: Only invest what you can afford to lose and conduct thorough research before making any investment decisions.

- Be Patient: Bitcoin is a long-term investment. Don’t expect to get rich quick. Be patient and ride out the market fluctuations.

Conclusion:

Bitcoin trends in 2025 point to a future where bitcoin will play an increasingly significant role in the global financial system. Regulatory clarity, institutional adoption, technological advancements, and growing use cases are expected to drive its continued growth and adoption. While challenges and uncertainties remain, the potential benefits of bitcoin are attracting investors, businesses, and governments worldwide. As the cryptocurrency landscape continues to evolve, it will be crucial to stay informed, adapt to new trends, and embrace the opportunities that bitcoin offers.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Bitcoin Trends in 2025. We thank you for taking the time to read this article. See you in our next article!