Navigating the Future: Banking Trends Shaping 2025 and Beyond

Related Articles: Navigating the Future: Banking Trends Shaping 2025 and Beyond

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: Banking Trends Shaping 2025 and Beyond. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Banking Trends Shaping 2025 and Beyond

The financial landscape is constantly evolving, driven by technological advancements, shifting customer expectations, and evolving regulatory environments. Banking trends 2025 represent a confluence of these forces, shaping the future of financial services and impacting how individuals and businesses interact with their money.

Understanding the Forces Shaping Banking Trends 2025

Several key drivers are shaping the future of banking, influencing the trends that will define the industry in 2025 and beyond:

- Technological Advancements: Artificial intelligence (AI), machine learning (ML), blockchain, and cloud computing are transforming banking operations. These technologies streamline processes, enhance security, and personalize customer experiences.

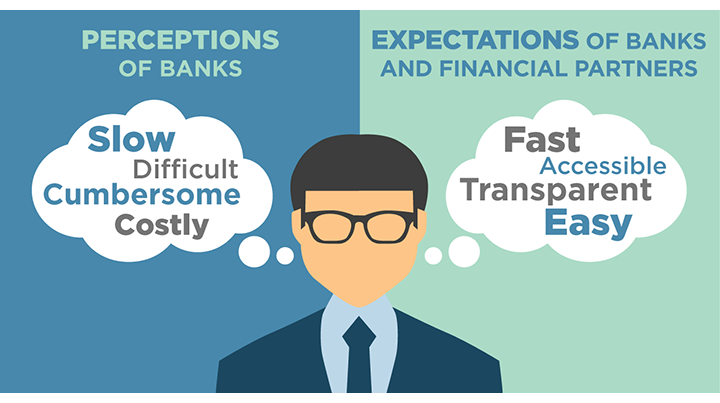

- Customer Expectations: Millennials and Gen Z are increasingly demanding digital-first experiences, expecting seamless, personalized, and secure banking services accessible anytime, anywhere.

- Regulatory Landscape: Evolving regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), are shaping data privacy and security practices, influencing how banks manage customer information.

- Competitive Landscape: The emergence of fintech companies and the increasing competition from non-traditional players are forcing traditional banks to innovate and adapt to remain competitive.

Key Trends Shaping the Future of Banking

1. Hyper-Personalization and AI-Powered Experiences

- AI-driven customer insights: Banks are leveraging AI and ML to analyze customer data, understanding their financial needs and preferences. This allows for tailored financial products and services, personalized recommendations, and proactive financial guidance.

- Personalized financial advice: Chatbots and virtual assistants powered by AI are becoming increasingly common, providing personalized financial advice, answering queries, and facilitating transactions.

- Predictive analytics for risk management: AI-powered algorithms are enabling banks to analyze vast amounts of data, identifying potential risks and fraud in real-time, enhancing risk management and fraud detection capabilities.

2. Seamless Digital Banking Experience

- Omnichannel banking: The future of banking is omnichannel, offering a consistent and seamless experience across all touchpoints, including mobile apps, online platforms, physical branches, and voice assistants.

- Mobile-first banking: Mobile banking apps are becoming the primary interface for banking, offering a range of features including account management, payments, transfers, and investment management.

- Biometric authentication: Facial recognition, fingerprint scanning, and voice recognition are enhancing security and convenience, streamlining the authentication process.

3. Open Banking and Data Sharing

- Data sharing and collaboration: Open banking initiatives are enabling banks to share data with third-party providers, allowing customers to access a wider range of financial services and manage their finances more effectively.

- Personalized financial management: Open banking empowers customers to aggregate their financial data across multiple accounts, providing a comprehensive view of their finances and enabling them to make informed financial decisions.

- Innovation and competition: Open banking fosters innovation by creating opportunities for fintech startups and other non-traditional players to develop new financial products and services, increasing competition and benefiting customers.

4. Rise of Fintech and Embedded Finance

- Fintech disruption: Fintech companies are disrupting traditional banking by offering innovative solutions for payments, lending, investments, and financial management, challenging the status quo and forcing banks to adapt.

- Embedded finance: Financial services are being integrated into non-financial platforms, such as e-commerce websites, ride-sharing apps, and social media platforms, making financial services more accessible and convenient.

- Partnerships and collaborations: Banks are increasingly collaborating with fintech companies, leveraging their expertise and technologies to enhance their offerings and stay competitive.

5. Sustainable Finance and ESG Investing

- Environmental, social, and governance (ESG) considerations: Investors and customers are increasingly demanding that banks align their practices with ESG principles, considering environmental, social, and governance factors in their investment decisions.

- Sustainable financial products: Banks are developing sustainable financial products, such as green bonds and impact investments, supporting environmentally and socially responsible projects.

- Transparency and reporting: Banks are being held accountable for their ESG performance, with increased transparency and reporting requirements to ensure ethical and sustainable practices.

6. Blockchain and Decentralized Finance (DeFi)

- Blockchain technology: Blockchain offers a secure, transparent, and efficient way to manage transactions, potentially revolutionizing banking operations and enabling new financial products and services.

- Decentralized finance (DeFi): DeFi platforms are using blockchain technology to offer alternative financial services, such as lending, borrowing, and trading, without intermediaries.

- Cryptocurrency integration: Banks are exploring ways to integrate cryptocurrencies into their offerings, providing access to digital assets and facilitating transactions using blockchain technology.

7. Cybersecurity and Data Privacy

- Sophisticated cyber threats: Cybersecurity threats are becoming increasingly sophisticated, requiring banks to invest in robust security measures to protect customer data and prevent fraud.

- Data privacy regulations: Regulations such as GDPR and CCPA are shaping data privacy practices, requiring banks to obtain explicit consent from customers before collecting and using their data.

- Data encryption and security protocols: Banks are implementing advanced encryption techniques and security protocols to safeguard customer data and ensure compliance with data privacy regulations.

8. The Future of Banking: A Human-Centric Approach

- Personalized financial guidance: AI-powered tools are providing personalized financial guidance, helping customers make informed decisions and achieve their financial goals.

- Financial literacy and education: Banks are playing an increasingly active role in promoting financial literacy and education, empowering customers to manage their finances effectively.

- Building trust and relationships: While technology is transforming banking, human interaction remains crucial. Banks are focusing on building trust and relationships with customers, offering personalized service and support.

Related Searches

- Banking trends 2025: This search term encompasses all the trends discussed in this article, providing a comprehensive overview of the future of banking.

- Future of banking: This search term explores the long-term implications of the trends shaping the industry, highlighting the potential disruptions and opportunities.

- Digital banking trends: This search term focuses on the specific trends related to digital banking, including mobile banking, online platforms, and digital payments.

- Fintech trends: This search term explores the latest trends in the fintech industry, including the rise of new technologies and the impact on traditional banking.

- Open banking trends: This search term focuses on the development and implications of open banking initiatives, including data sharing, innovation, and competition.

- Cybersecurity in banking: This search term explores the growing importance of cybersecurity in the banking industry, highlighting the challenges and solutions for protecting customer data.

- Sustainable finance trends: This search term focuses on the growing trend of sustainable finance, including ESG investing, green bonds, and impact investments.

- Blockchain in banking: This search term explores the potential applications of blockchain technology in banking, including transaction processing, data security, and new financial products.

FAQs about Banking Trends 2025

Q: How will banking trends 2025 impact customers?

A: Customers will benefit from a more personalized and seamless banking experience, with access to a wider range of financial products and services. AI-powered tools will provide personalized financial guidance, and open banking initiatives will empower customers to manage their finances more effectively. However, it is crucial to be aware of the potential risks associated with data privacy and cybersecurity.

Q: What are the biggest challenges facing banks in 2025?

A: Banks face several challenges, including adapting to rapidly evolving technologies, meeting the demands of digitally savvy customers, managing cybersecurity risks, and complying with evolving regulations. Competition from fintech companies and the rise of open banking are also significant challenges.

Q: What role will technology play in the future of banking?

A: Technology will play a pivotal role in shaping the future of banking. AI, ML, blockchain, and other technologies will streamline operations, enhance security, personalize customer experiences, and enable new financial products and services. However, it is important to ensure that technology is used responsibly and ethically.

Q: What are the opportunities for banks in 2025?

A: The future of banking offers significant opportunities for banks that can adapt to the changing landscape. By embracing innovation, focusing on customer experience, and leveraging technology responsibly, banks can create new revenue streams, enhance customer loyalty, and remain competitive.

Tips for Banks Navigating Banking Trends 2025

- Embrace innovation: Invest in research and development, explore new technologies, and collaborate with fintech companies to develop innovative financial products and services.

- Focus on customer experience: Prioritize customer needs and preferences, offering personalized experiences, seamless digital interactions, and exceptional customer service.

- Strengthen cybersecurity: Invest in robust cybersecurity measures to protect customer data and prevent fraud, ensuring compliance with data privacy regulations.

- Promote financial literacy: Educate customers about financial products and services, empowering them to manage their finances effectively.

- Embrace sustainability: Align business practices with ESG principles, developing sustainable financial products and supporting environmentally and socially responsible projects.

Conclusion

Banking trends 2025 represent a period of significant transformation for the financial services industry. By understanding the key drivers shaping these trends and embracing innovation, banks can navigate the changing landscape, create new opportunities, and deliver value to customers in a rapidly evolving world. The future of banking is one of personalized experiences, digital convenience, and responsible financial practices, driven by technology and a human-centric approach.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Banking Trends Shaping 2025 and Beyond. We thank you for taking the time to read this article. See you in our next article!