Navigating the Forex Market in 2025: Trends, Strategies, and Opportunities

Related Articles: Navigating the Forex Market in 2025: Trends, Strategies, and Opportunities

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Forex Market in 2025: Trends, Strategies, and Opportunities. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Forex Market in 2025: Trends, Strategies, and Opportunities

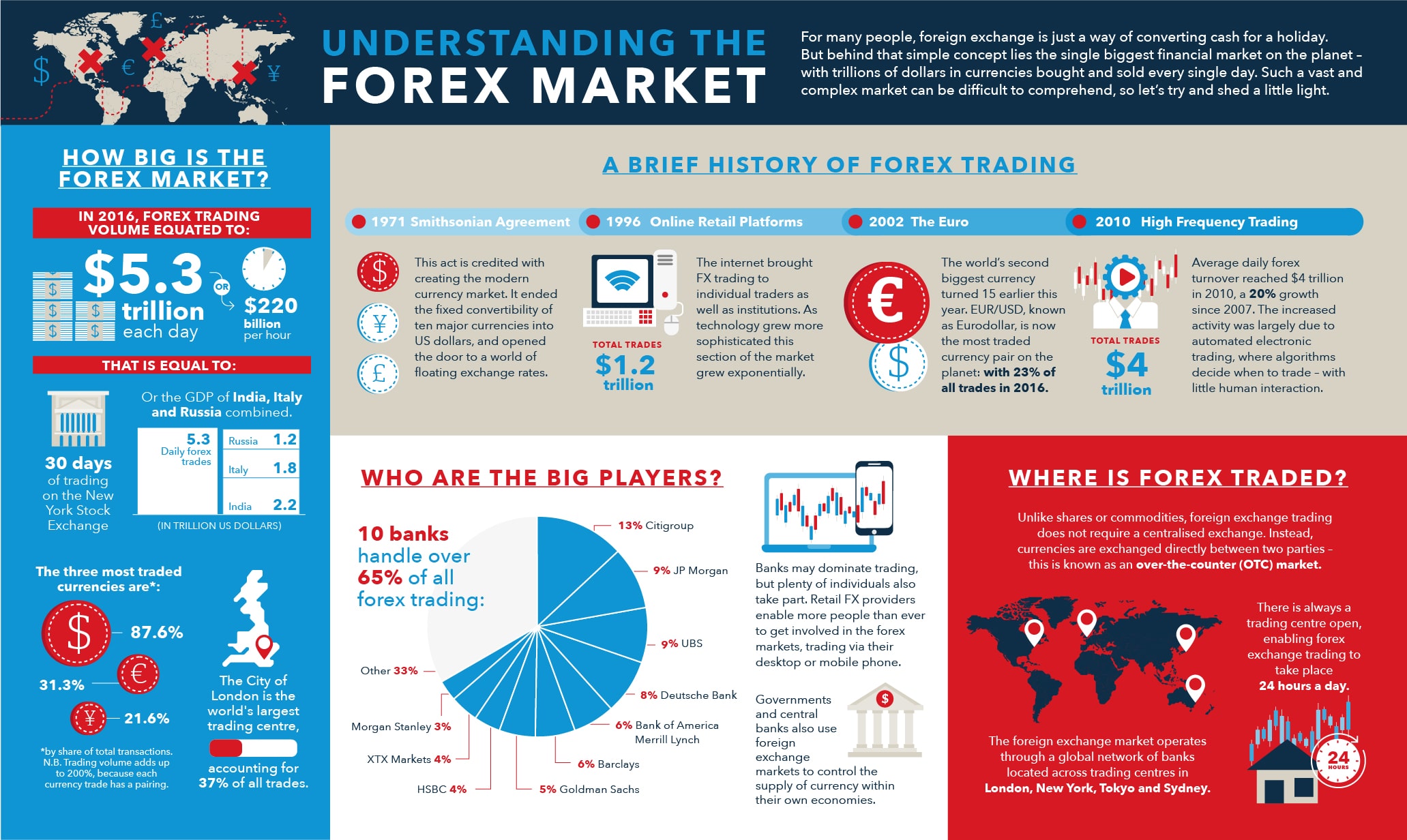

The foreign exchange market, often referred to as Forex, is the largest and most liquid financial market globally. It facilitates the exchange of currencies, influencing international trade, investment, and economic stability. As we approach 2025, understanding the evolving landscape of Forex trading becomes crucial for investors and traders alike. This article explores the key trends shaping the Forex market in the coming years, examining the factors driving these trends, and providing insights into potential opportunities and challenges.

Key Trends Shaping the Forex Market in 2025

1. Increased Automation and Algorithmic Trading:

The adoption of artificial intelligence (AI) and machine learning (ML) is revolutionizing Forex trading. Algorithmic trading systems, driven by sophisticated algorithms, can analyze vast amounts of data, identify patterns, and execute trades at lightning speed. This automation allows for faster execution, improved risk management, and potentially higher returns, making it increasingly popular among institutional and individual traders.

2. Growing Role of Cryptocurrency and Digital Assets:

The emergence of cryptocurrencies and other digital assets has significantly impacted the Forex market. While cryptocurrencies are not technically considered currencies in the traditional sense, they are traded on exchanges and influence currency values. The increasing volatility of cryptocurrencies can create opportunities for Forex traders, but also poses challenges due to the inherent risks associated with these assets.

3. Rise of Mobile Trading Platforms and Accessibility:

The accessibility of mobile trading platforms has democratized Forex trading, allowing individuals to participate in the market from anywhere with an internet connection. These platforms offer user-friendly interfaces, real-time data, and advanced analytical tools, making Forex trading more accessible to a broader audience.

4. Regulatory Landscape and Compliance:

The regulatory landscape surrounding Forex trading is constantly evolving. As markets become more globalized, international regulatory bodies are working to harmonize rules and regulations to ensure market integrity and protect investors. Traders must stay informed about these regulations to ensure compliance and avoid legal issues.

5. Focus on Sustainability and ESG Investing:

The growing awareness of environmental, social, and governance (ESG) factors is influencing investment decisions across all asset classes, including Forex. Traders are increasingly considering the sustainability practices of countries and companies whose currencies they trade, potentially leading to shifts in market sentiment and investment flows.

6. Geopolitical Events and Economic Uncertainty:

Global events, such as political instability, trade wars, and natural disasters, can significantly impact currency values. Traders need to stay informed about geopolitical developments and their potential impact on economic indicators, such as interest rates, inflation, and economic growth, which directly influence currency exchange rates.

7. Technological Advancements in Data Analytics and Predictive Modeling:

Advancements in data analytics and predictive modeling are providing traders with more sophisticated tools for analyzing market trends and forecasting future price movements. These tools, powered by AI and ML, can help traders identify potential opportunities and manage risks more effectively.

8. Increased Competition and Market Fragmentation:

The Forex market is becoming increasingly competitive, with a growing number of brokers, trading platforms, and financial institutions vying for market share. This competition can benefit traders by offering more choices and potentially lower trading costs, but it also requires traders to be more discerning in selecting their trading partners.

Understanding the Importance of Forex Trading Trends

Staying informed about the evolving trends in Forex trading is crucial for several reasons:

- Strategic Decision Making: Understanding market trends allows traders to make informed decisions about which currencies to trade, when to enter and exit positions, and how to manage risk effectively.

- Identifying Opportunities: Emerging trends can present new opportunities for traders, such as trading in niche markets or using innovative trading strategies.

- Staying Competitive: As the Forex market evolves, traders need to adapt their strategies and embrace new technologies to remain competitive.

- Managing Risk: By understanding the factors driving market trends, traders can better assess potential risks and develop strategies for mitigating them.

Related Searches

The following related searches provide further insights into the Forex market and its trends:

- Best Forex Trading Platforms: Exploring the top platforms based on features, security, and user experience.

- Forex Trading Strategies: Examining different trading techniques, such as scalping, day trading, and swing trading.

- Forex Trading Signals: Understanding the use of technical indicators and other tools to generate trading signals.

- Forex Trading Education: Accessing resources for learning about Forex trading fundamentals, strategies, and risk management.

- Forex Trading News and Analysis: Staying updated on market news, economic data releases, and expert analysis.

- Forex Trading Psychology: Exploring the psychological aspects of trading, such as managing emotions and avoiding common biases.

- Forex Trading Regulations: Understanding the legal framework governing Forex trading in different jurisdictions.

- Forex Trading Risks: Recognizing and mitigating the inherent risks associated with Forex trading.

FAQs about Forex Trading Trends in 2025

1. What are the key factors driving the growth of algorithmic trading in Forex?

The growth of algorithmic trading is driven by several factors, including:

- Speed and Efficiency: Algorithms can execute trades at lightning speed, capturing fleeting market opportunities and minimizing slippage.

- Data Analysis: Algorithms can process vast amounts of data, identifying patterns and trends that might be missed by human traders.

- Risk Management: Algorithmic trading systems can be programmed to manage risk effectively, reducing the potential for emotional biases that can affect human decision-making.

- 24/7 Operation: Algorithmic trading systems can operate continuously, monitoring markets even when human traders are not available.

2. How will the increasing influence of cryptocurrency affect Forex trading?

The influence of cryptocurrency on Forex trading is multifaceted:

- Volatility: Cryptocurrencies are highly volatile, creating opportunities for traders to profit from price swings.

- Correlation: The price movements of cryptocurrencies can influence the values of fiat currencies, creating trading opportunities in currency pairs.

- New Trading Instruments: Cryptocurrencies have led to the development of new trading instruments, such as crypto-cross pairs and crypto-fiat pairs.

- Regulation: Regulatory developments surrounding cryptocurrencies will have a significant impact on Forex trading, particularly in terms of compliance and risk management.

3. What are the benefits of using mobile trading platforms for Forex?

Mobile trading platforms offer several advantages:

- Accessibility: Traders can access the market from anywhere with an internet connection, offering greater flexibility and convenience.

- User-Friendly Interface: Mobile platforms are designed for ease of use, making it easier for beginners to navigate and understand.

- Real-time Data: Mobile platforms provide access to real-time market data, charts, and news feeds, allowing traders to stay informed about market movements.

- Advanced Tools: Many mobile platforms offer advanced analytical tools, such as technical indicators, charting tools, and order management features.

4. How will ESG factors influence Forex trading in the future?

ESG factors are expected to have a growing influence on Forex trading:

- Investment Flows: Investors increasingly favor companies and countries with strong ESG credentials, potentially influencing currency values.

- Market Sentiment: Negative news about a country’s environmental or social practices could lead to a decline in its currency value.

- Regulatory Pressure: Governments and regulatory bodies are increasingly focusing on ESG issues, potentially leading to stricter regulations for companies and countries with poor ESG performance.

5. What are the key challenges traders face in navigating the evolving Forex market?

Traders face several challenges in the evolving Forex market:

- Keeping Up with Trends: The rapid pace of change in the Forex market requires traders to constantly learn and adapt their strategies.

- Technological Complexity: The increasing reliance on technology, particularly AI and ML, can be daunting for traders who lack technical expertise.

- Regulatory Compliance: Staying informed about evolving regulations and ensuring compliance can be challenging.

- Market Volatility: Geopolitical events and economic uncertainty can lead to significant market volatility, increasing risk for traders.

Tips for Successful Forex Trading in 2025

1. Develop a Solid Trading Plan: A well-defined trading plan outlines your trading goals, risk tolerance, entry and exit strategies, and money management rules.

2. Continuously Learn and Adapt: The Forex market is constantly evolving, so it is essential to stay informed about market trends, new trading strategies, and regulatory developments.

3. Embrace Technology: Utilize advanced trading platforms, analytical tools, and AI-powered solutions to improve your decision-making and risk management.

4. Manage Your Risk: Never risk more than you can afford to lose, and use appropriate risk management techniques to protect your capital.

5. Stay Disciplined and Emotional: Avoid emotional trading decisions and stick to your trading plan, even when faced with market volatility.

6. Choose the Right Broker: Select a reputable broker with a strong track record, competitive trading conditions, and excellent customer support.

7. Seek Professional Guidance: Consider working with a qualified financial advisor or forex mentor to gain insights and support.

Conclusion

The Forex market is expected to continue evolving rapidly in the coming years, driven by technological advancements, geopolitical events, and shifting investor priorities. Traders who understand the key trends shaping the market, adapt their strategies, and embrace new technologies will be well-positioned to navigate this dynamic landscape and capitalize on emerging opportunities. By staying informed, continuously learning, and managing risk effectively, traders can increase their chances of success in the Forex market in 2025 and beyond.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Forex Market in 2025: Trends, Strategies, and Opportunities. We appreciate your attention to our article. See you in our next article!