Navigating the Evolving Landscape: Banking Industry Trends in 2025

Related Articles: Navigating the Evolving Landscape: Banking Industry Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Evolving Landscape: Banking Industry Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Evolving Landscape: Banking Industry Trends in 2025

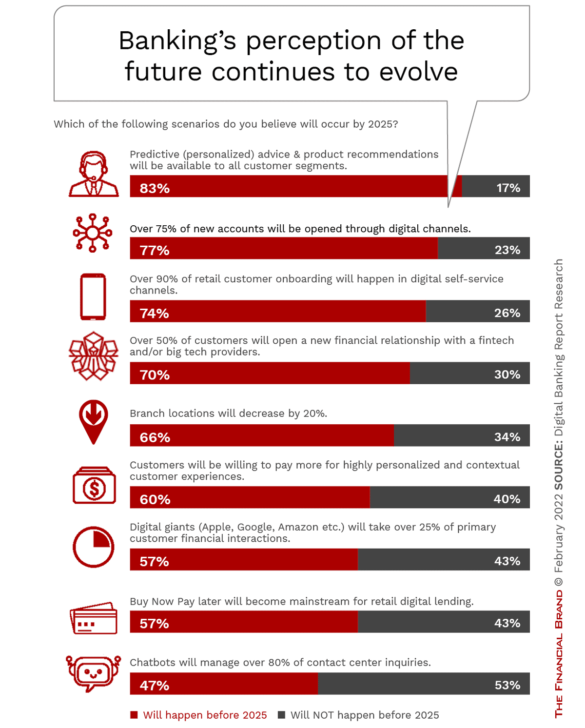

The banking industry is in a state of constant evolution, driven by technological advancements, changing customer expectations, and a dynamic global economic environment. As we approach 2025, several key trends are shaping the future of banking, presenting both challenges and opportunities for financial institutions. This article delves into these trends, offering insights into their impact and potential implications.

1. The Rise of Open Banking and Data-Driven Services:

Open banking is a paradigm shift in banking, enabling customers to share their financial data with third-party applications and services with their consent. This opens up a vast ecosystem of possibilities, allowing for innovative financial products and services tailored to individual needs.

Benefits of Open Banking:

- Personalized Financial Solutions: Data sharing allows for the development of personalized financial products and services, such as tailored budgeting tools, automated investment management, and personalized loan offers.

- Enhanced Competition: Open banking fosters competition by allowing fintech companies to offer innovative services, challenging traditional banking models.

- Increased Customer Choice: Customers gain greater control over their financial data and access to a wider range of financial services.

Challenges of Open Banking:

- Data Security and Privacy Concerns: Sharing sensitive financial data requires robust security measures to mitigate risks of data breaches and identity theft.

- Regulatory Complexity: Implementing open banking frameworks necessitates navigating complex regulatory landscapes and ensuring compliance with data privacy laws.

- Integration Challenges: Integrating third-party applications and services into existing banking systems can pose technical and logistical challenges.

2. The Proliferation of FinTech and Embedded Finance:

FinTech companies are disrupting the traditional banking landscape by offering innovative solutions in areas like payments, lending, and wealth management. This disruption is further fueled by the emergence of embedded finance, which integrates financial services seamlessly into non-financial platforms, such as e-commerce sites, social media platforms, and even gaming apps.

Impact of FinTech and Embedded Finance:

- Increased Accessibility and Convenience: FinTech and embedded finance solutions offer greater accessibility and convenience, enabling customers to access financial services anytime, anywhere.

- Lower Costs and Improved Efficiency: Innovative technologies employed by FinTech companies can lead to lower costs and improved efficiency in delivering financial services.

- New Revenue Streams: Traditional banks are exploring partnerships with FinTech companies and adopting embedded finance strategies to tap into new revenue streams.

3. The Growing Importance of Digital and Mobile Banking:

The pandemic accelerated the adoption of digital and mobile banking, highlighting the need for seamless and intuitive online banking experiences. This trend is expected to continue, with banks investing heavily in user-friendly mobile apps and online platforms offering a wide range of financial services.

Benefits of Digital and Mobile Banking:

- Enhanced User Experience: Digital banking platforms offer a more convenient and user-friendly experience, allowing customers to manage their finances anytime, anywhere.

- Increased Efficiency: Digital banking processes automate tasks and streamline operations, leading to increased efficiency and reduced costs.

- Improved Customer Engagement: Digital channels provide opportunities for personalized communication and enhanced customer engagement through features like chatbots and personalized notifications.

4. The Rise of Artificial Intelligence (AI) and Machine Learning (ML):

AI and ML are transforming the banking industry by automating tasks, improving decision-making, and personalizing customer experiences. These technologies are being implemented in areas like fraud detection, credit risk assessment, and customer service.

Applications of AI and ML in Banking:

- Fraud Detection and Prevention: AI algorithms can analyze transaction patterns and identify potential fraudulent activities in real-time, enhancing security measures.

- Credit Risk Assessment: ML models can analyze vast datasets to assess creditworthiness, enabling faster and more accurate loan approvals.

- Personalized Customer Service: AI-powered chatbots and virtual assistants can provide 24/7 customer support, answering questions and resolving issues efficiently.

5. The Growing Importance of Cybersecurity:

As the banking industry becomes increasingly digital, cybersecurity is paramount. Banks must invest in robust security measures to protect customer data from cyberattacks, data breaches, and other security threats.

Cybersecurity Measures for Banks:

- Multi-Factor Authentication: Implementing multi-factor authentication adds an extra layer of security by requiring users to provide multiple forms of identification.

- Encryption and Data Masking: Encrypting sensitive data and masking sensitive information can prevent unauthorized access and data breaches.

- Regular Security Audits and Penetration Testing: Conducting regular security audits and penetration testing helps identify vulnerabilities and strengthen security measures.

6. The Shift Towards Sustainability and Environmental, Social, and Governance (ESG) Factors:

Banks are increasingly recognizing the importance of sustainability and incorporating ESG factors into their operations and investment decisions. This includes supporting sustainable businesses, reducing their own environmental impact, and promoting responsible lending practices.

ESG Considerations in Banking:

- Sustainable Finance: Banks are developing products and services that promote sustainable investments and support businesses with strong ESG performance.

- Climate Change Mitigation: Banks are taking steps to reduce their own carbon footprint and mitigate the financial risks associated with climate change.

- Responsible Lending Practices: Banks are implementing responsible lending policies to ensure that loans are used for sustainable purposes and do not contribute to harmful environmental or social practices.

7. The Evolution of Payment Systems and the Rise of Digital Currencies:

The banking industry is witnessing a rapid evolution in payment systems, with the emergence of new technologies like contactless payments, mobile wallets, and real-time payments. Additionally, the rise of digital currencies, such as Bitcoin and stablecoins, is presenting both opportunities and challenges for banks.

Impact of Digital Currencies on Banking:

- New Payment Options: Digital currencies offer alternative payment options, potentially disrupting traditional banking systems.

- Cross-Border Payments: Digital currencies can facilitate faster and more cost-effective cross-border payments.

- Financial Inclusion: Digital currencies can potentially provide financial services to underserved populations without access to traditional banking.

8. The Growing Importance of Customer Experience and Personalization:

Customer experience is becoming increasingly critical for banks, as competition intensifies and customers demand personalized and seamless banking experiences. Banks are investing in technologies and strategies to enhance customer engagement and deliver tailored financial solutions.

Strategies for Enhancing Customer Experience:

- Personalized Communication: Utilizing data analytics to personalize communication with customers based on their individual needs and preferences.

- Omnichannel Banking: Providing a consistent and seamless banking experience across multiple channels, including mobile apps, online platforms, and physical branches.

- Customer Feedback Mechanisms: Implementing systems for collecting and responding to customer feedback, enabling continuous improvement in customer service.

Related Searches:

- Banking Technology Trends 2025: This search focuses on specific technologies shaping the future of banking, such as AI, blockchain, and cloud computing.

- Future of Banking 2025: This search explores broader predictions about the future of the banking industry, including the impact of regulatory changes, economic trends, and societal shifts.

- Digital Banking Trends 2025: This search delves into the evolving landscape of digital banking, including the adoption of mobile banking, online platforms, and digital payment methods.

- FinTech Trends 2025: This search examines the latest innovations in FinTech, including the rise of embedded finance, alternative lending models, and the impact of blockchain technology.

- Open Banking Regulations 2025: This search explores the regulatory landscape surrounding open banking, including the implementation of data privacy laws and the impact on financial institutions.

- Cybersecurity in Banking 2025: This search focuses on cybersecurity threats and solutions in the banking industry, including data breach prevention, fraud detection, and the use of advanced security technologies.

- Sustainable Banking Trends 2025: This search explores the growing importance of sustainability in banking, including the development of green finance products, investments in renewable energy, and responsible lending practices.

- Digital Currency Trends 2025: This search examines the evolving landscape of digital currencies, including the impact of cryptocurrencies, central bank digital currencies (CBDCs), and the potential disruption of traditional banking systems.

FAQs:

Q: How will these trends impact the banking industry in 2025?

A: These trends are poised to fundamentally transform the banking industry, leading to a more competitive, digital, and customer-centric landscape. Traditional banking models will evolve, with a greater emphasis on innovation, technology, and customer experience.

Q: What are the key challenges facing banks in adapting to these trends?

A: Banks face challenges in adapting to these trends, including:

- Investing in new technologies: Banks need to invest heavily in new technologies to remain competitive and meet evolving customer expectations.

- Attracting and retaining talent: The industry needs to attract and retain skilled professionals with expertise in areas like data analytics, cybersecurity, and digital banking.

- Managing regulatory complexity: Navigating complex and evolving regulations related to data privacy, open banking, and digital currencies is crucial.

Q: What steps can banks take to prepare for these trends?

A: Banks can prepare for these trends by:

- Embracing digital transformation: Investing in digital technologies and creating a robust digital banking infrastructure.

- Building strategic partnerships: Collaborating with FinTech companies and other industry players to leverage innovation and access new markets.

- Prioritizing customer experience: Focusing on delivering personalized and seamless customer experiences across all channels.

- Investing in cybersecurity: Strengthening cybersecurity measures to protect customer data and mitigate risks.

Tips for Banks:

- Embrace a culture of innovation: Encourage experimentation and foster a culture that values innovation and disruption.

- Develop a strong data strategy: Leverage data analytics to gain insights into customer behavior and develop personalized solutions.

- Invest in talent development: Train employees to develop skills in areas like digital banking, cybersecurity, and data analytics.

- Build a strong brand presence: Differentiate your brand and build strong relationships with customers through personalized communication and exceptional service.

Conclusion:

The banking industry is on the cusp of significant transformation, driven by technological advancements, changing customer expectations, and a dynamic global economic environment. The trends discussed in this article will continue to shape the industry in the coming years, presenting both challenges and opportunities for financial institutions. Banks that embrace these trends, invest in innovation, and prioritize customer experience will be well-positioned to thrive in the evolving banking landscape of 2025 and beyond.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Evolving Landscape: Banking Industry Trends in 2025. We appreciate your attention to our article. See you in our next article!